Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2023

Updated: September 30, 2023

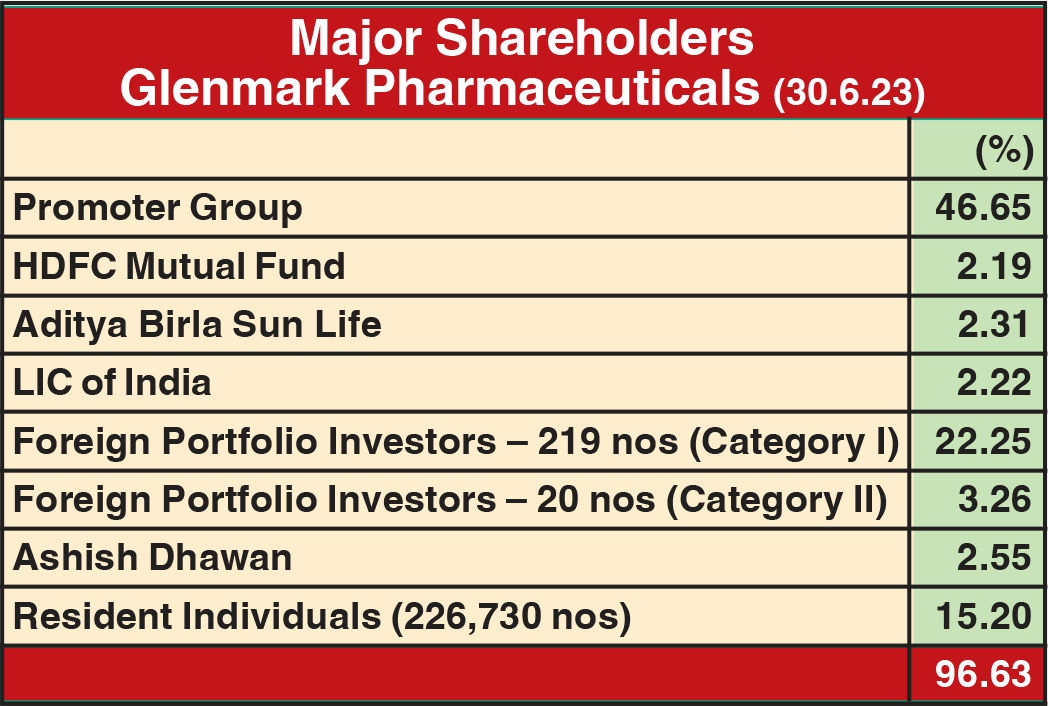

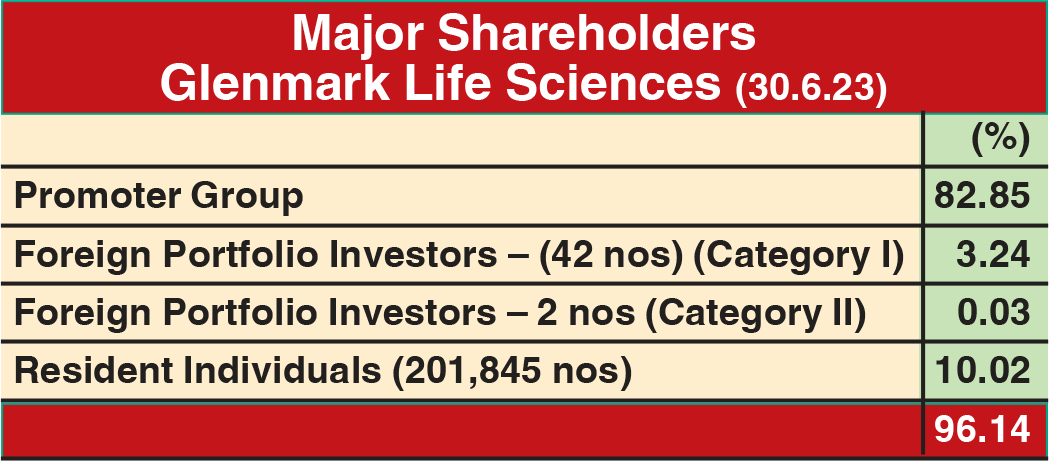

In just over two years of listing its subsidiary, Glenmark Life Sciences (GLS), on NSE and BSE, holding company Glenmark Pharmaceuticals (GPL) has entered into a definitive agreement with Ahmedabad-based Nirma Ltd to divest 75% stake in GLS out of 82.84% it holds in the company. GPL intends to continue with the balance 7.84% stake in GLS. At Rs 615 per share, GPL will get an aggregate consideration of Rs 5,651.50 crore. Pursuant to this transaction, Nirma will make a mandatory open offer to all public shareholders of GLS for 17.15% at Rs 631 per share.

It is worth pointing out that against the Rs 631 per share offer to public shareholders of GLS, its current market price is Rs 624, whereas the company’s IPO in July 2021 was priced at Rs 720 per share (Rs 2 face value). It means they would be at loss of Rs. 89 per share to the issue price, which translates into a loss of 12.36% after holding their investments for over two years. More importantly, the Nirma group, the acquirer, does not have a sound background in pharma.

Commenting on the divestment, Glenn Saldanha, Chairman and Managing Director, Glenmark Pharmaceuticals Limited, said, “We are pleased to announce this strategic transaction with Nirma, which marks a significant milestone in shaping an independent growth trajectory for GLS. This deal aligns with Glenmark’s strategic intent of moving up the value chain to become an innovative/brand led organization, with continuous focus on our core therapeutic areas of dermatology, respiratory and oncology. It also presents an opportunity for us to strengthen shareholder value through deleveraging and enhancing our overall return profile.”

In his reaction to the development, Dr Yasir Rawjee, Managing Director and CEO, GLS, said “This announcement marks the next step in the journey of the company, one that will accelerate growth and help create more value for our stakeholders in the long term. We will continue to operate as an independent API company under the new ownership of Nirma Limited. I see this as an opportunity to further strengthen our position in the API industry and continue the growth trajectory.”

The transaction will help strengthen GPL’s balance sheet, as the company will utilize the sale proceeds to prepay its entire debt, making it net debt-negative. GLS contributes about 11% to the consolidated revenue and about 25% to the operating profits of the consolidated entity. GLS and Nirma have agreed to certain non-compete and non-solicit arrangements for a specific period. GPL will continue to have a five-year procurement agreement with GLS as GPL procures about 15% of its API requirements from GLS.

As of March 2023, GPL had a consolidated long-term borrowing of Rs 3,852.14 crore (PY: Rs 2,571.74 crore) and short-term borrowing of Rs 495.59 crore (PY: Rs 1,098.60 crore), resulting in a combined debt of Rs 4,348 crore (PY: Rs 3,670 crore). Post the GLS realisation, GPL’s finance cost will get reduced to almost zero – it has been Rs 349.58 crore in FY23 and Rs 298.09 crore in the FY22.

India Ratings and Research (Ind-Ra) has placed GPL’s bank facility ratings on ‘Rating Watch’ with positive implications, which indicates that the ratings may be either affirmed or upgraded. Some of their observations are being summarized here to get a better insight:

Subdued performance in FY23: In FY23, consolidated revenue grew by only 5.6% yoy to Rs 129.9 billion, led by the muted performance of GPL’s India and US businesses (jointly accounting for 55% of its sales). The consolidated EBITDA margin fell to 17.5% in FY23 (FY22: 18.9%), due to higher operating expenses (FY23: 7.3% yoy; 12.7% yoy) and staff cost (13.6% yoy; 4.4% yoy). In Q1FY24, revenue increased 22.5% yoy to Rs 34 billion, led by strong growth across geographies (US: over 22.0% yoy; rest of the world (RoW): over 30.4% yoy; Europe: over 73.7% yoy; API: over 15.9% yoy), except India (up by only 2.8% yoy).

The EBITDA margin remained healthy at 18.6% in Q1FY24 led by moderation in research and development (R&D) ing pressure to continue in the US business in the near term, but the impact of the same might be offset by its new launches. Ind-Ra expects GPL’s US business to continue to face delays in approvals and regulatory risks.

Diversified business profile: GPL remains a strong and consistent player in the domestic formulations business, with higher sales contribution from the chronic segment (57% of India business), which offers steady income and higher margins. Formulations account for 89% of the company’s sales, and APIs account for the rest. The company generates equal revenue from both regulated and semiregulated markets. In terms of geography, India and the US are the largest markets for the company, accounting for 31% and 24% respectively of its sales. Other geographies such as RoW (18%) and Europe (14%) jointly account for 32% of sales. In the US business, the top 10 products contribute on average 43-45% to sales. GPL has a large pipeline for the

US market, with 233 abbreviated new drug application (ANDA) filings, of which 183 ANDAs have been approved by the US Food and Drug Administration (USFDA). The company’s growth prospects are being driven by its R&D spend of around 11.5% of sales over FY17-FY23, which is higher than the average R&D spend of its peers.

India business on strong footing: GPL generates one-third of its total sales from its India formulations business, which grew 15.5% yoy to Rs 40.9 billion in FY22 (FY21: Rs 35.4 billion), led by a higher contribution by Fabiflu drug and new launches. The company has been recording steady revenue growth over the past 10 years (CAGR of around 15% as against around 10% of the Indian pharmaceuticals market) while maintaining a strong competitive position in cash flow-sticky chronic therapies (57% of India sales) which offer higher profitability. However, in FY23, the India business’s sales fell by 1.4% yoy to Rs 40.3 billion, due to the higher base in FY22, following Covid-19. Ind-Ra expects mid to low double-digit sales growth in the India business in FY24.

Regulatory overhang: GPL’s ratings continue to reflect the regulatory risk emanating from the price control, with around 10% of India sales under the drug price control order, and the USFDA’s regulatory scrutiny of the company’s manufacturing facilities. Three facilities of the company have been under the USFDA scanner: i) the Baddi plant received an import alert in October 2022 (warning letter in October 2019); ii) the Goa unit received a warning let

in November 2022 (official action indicated (OAI) in May 2022), and iii) the formulations manufacturing unit in Monroe, North Carolina, received a warning letter in June 2023. GPL settled its drug pricing case with the US Department of Justice in August 2023 ($ 30 million). Undoubtedly, GLS has good potential to accelerate its growth. However, it is equally important to wait and watch till the new management unfolds their business plans for the next level of growth for the company.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives