Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 15, 2024

Updated: April 15, 2024

This fortnight, we have selected a unique company with a history of interesting changes, including changes in management, during the last 146 years. The company is CG Power and Industrial Solutions Ltd. Formerly known as Crompton Greaves, it was set up in 1878 as REB Crompton and Company by Col Crompton, an Englishman. In 1927, it merged with FA Parkinson and was renamed Crompton Parkinson Ltd. Greaves Cotton and Company, set up by James Greaves, was appointed as the company’s concessionaire. In 1937, CPL established a wholly owned Indian subsidiary, Crompton Parkinson Works Ltd.

In 1947, an Indian business group entered the scene as Karamchand Thapar of the Thapar group acquired the company and renamed it Crompton Greaves Ltd. As the Thapar group faced trouble in 2014, the company was demerged and its consumer goods business was separated and sold to Advent International and Temasek Holding for Rs 2,000 crore by Gautam Thapar. The separated company was named Crompton Greaves Consumer Electricals Ltd (CGCEL) and the remaining company was named CG Power and Industrial Solutions Ltd.

Today, CG Power and Industrial Solutions Ltd is an Indian multinational engineering conglomerate with an impressive and diverse portfolio of products, solutions and services for power and industrial equipment and solutions, addressing myriad needs.

Since inception in 1937, the company has been a pioneer and has retained its leadership position in the management and application of electrical energy. Enjoying a reputation of stature for over seven decades, CG, which originates in India, has transformed itself into a global corporation. With a permanent footprint and manufacturing facilities in nine countries across Asia, Europe and North America, CG is fast emerging as a first- choice supplier of high-quality ‘smart’ electrical, industrial and consumer products and solutions all over the world.

The company’s unique and diverse portfolio includes transformers, switchgears, circuit breakers, network protection and control gear, project engineering, HT and LT motors, drivers, power customization products and turnkey solutions, thus enhancing the many aspects of industrial and personal life. This portfolio has been structured into 3 SBUs – industrial, power and railways.

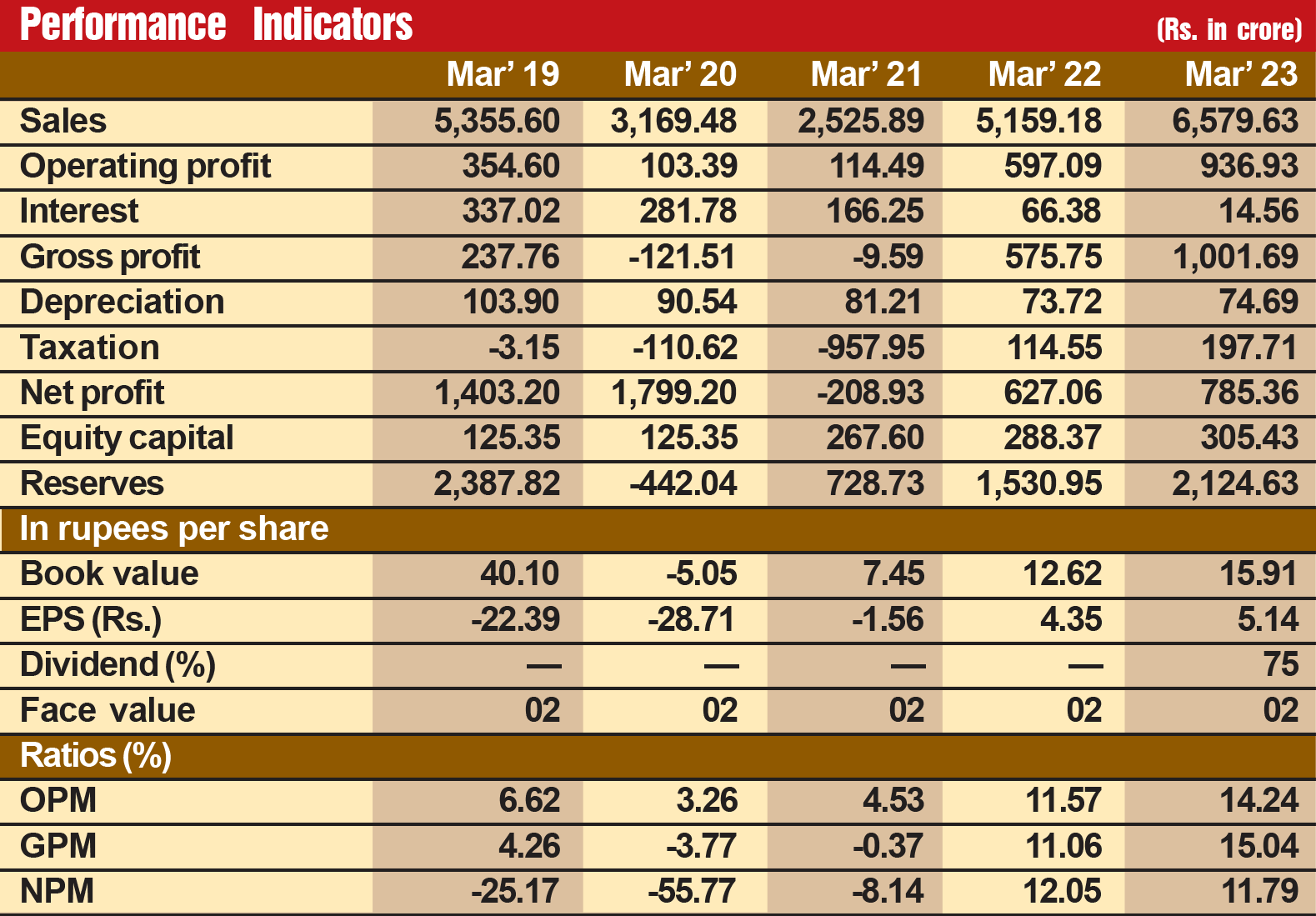

The company has gone from strength to strength on the financial front since it emerged as a separate company in 2016. During the last eight years, its sales turnover has expanded from Rs 5,269 crore in fiscal 2016 to Rs 6,973 crore in fiscal 2023, with operating profit shooting up around 12 times from Rs 88 crore to Rs 1,005 crore and the profit at net level in fiscal 2023 amounting to Rs 963 crore, in striking contrast to a net loss of Rs 461 crore in fiscal 2016.

However, we have not picked this stock as the Fortune Scrip for this fortnight on account of its glorious past or its robust financial performance so far. We strongly feel that the company’s future prospects are all the more exciting and its future may be more glorious than its past. Consider:

CG's size, stature and character will undergo a sea change with its proposed foray into the fascinating and lucrative space of semiconductors. The company has joined hands with Renesas Electronics Corporation of Japan and Stars Micro Electronics of Thailand for setting up a state-of-theart facility at Sanand in Gujarat with a capacity to manufacture 15 million semiconductors per day. In this joint venture, the lion's share of 92.3 per cent will be with CG, with Renesas holding 6.8 per cent and Stars having the balance stake of 0.9 per cent. The plant will require an investment of Rs 7,600 crore spread over a period of five years.

This foray into semiconductors will prove a mighty game changer for the fortunes of the company as there is an acute global shortage of semiconductors, with manufacturing centred in Taiwan, China, South Korea, Japan and the US, and demand rising by the day. Today in India, the indigenous production of semiconductors can meet only 9 per cent of the total requirement and the country has to import the balance 91 per cent by spending valuable foreign exchange. The India government has recently given the green signal to three plants, two by the Tata group and the third one by CG Power.

With the plant going on stream by 2025, the company's topline as well as bottomline will undergo a dramatic change, transforming CG into a blue chip company. The company's existing major business systems are doing quite well. As on December 31, 2023, the unexecuted order book was at Rs 1,982 crore, representing a 9 per cent yoy rise. In the interim budget for 2024, the finance minister recommended increased capital spending of Rs 11.4 lakh crore. This will support CG's expansion in cement, steel and related industries

The government's emphasis on energy efficiency will increase demand for higher energy standard motors such as IE3 and IE4. Government energy efficiency standards may significantly increase demand for these motors. GC Power is a leading manufacturer of such motors.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives