Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 15, 2024

Updated: April 15, 2024

Promoted by Haridas Kanani, a chemical engineer from IIT-Mumbai, the NSE-BSE listed Neogen Chemicals Ltd (NCL) is one of India’s leading manufacturers of bromine-based and lithium-based speciality chemicals. Its speciality chemicals product offerings comprise organic as well as inorganic chemicals. Its products are used in pharmaceutical and agrochemical intermediates, engineering fluids, electronic chemicals, polymer additives, water treatment, construction chemicals, aroma chemicals, flavours and fragrances, speciality polymers, chemicals and vapour absorption chillers, OEMs and upcoming usage in lithium-ion battery materials for energy storage and electric vehicle (EV) applications.

Over the years, Neogen has expanded its range of products and at present manufactures an extensive range of speciality chemicals which find applications across various industries in India and globally. It has a portfolio of over 248 products. The technocrat- promoters and their committed involvement is the company’s foremost strength. In addition to manufacturing speciality chemicals, Neogen also undertakes custom synthesis and contract manufacturing where the product is developed and customised primarily for a specific customer, but process know-how and technical specifications are developed inhouse. Of late, the contribution of custom synthesis to revenues is on the rise.

The company recently announced plans to utilise its three decades of experience in lithium chemistry to manufacture lithium-ion battery materials, with an initial investment plan of manufacturing electrolytes and lithium electrolyte salts. It is also the largest importer of lithium carbonate and lithium hydroxide for the last three decades, and hence enjoys a strong relationship with leading global miners and processors in the lithium space.

NCL exports to over 30 countries, with a major presence in the US, Europe, Japan and the Middle East. The current geopolitical uncertainties have impacted several in dustries and the chemical industry is among those facing complex challenges. NCL is no exception as it could not achieve the desired growth momentum in its exports revenue, mainly due to the ongoing Russia-Ukraine conflict, the Red Sea crisis, global inventory destocking and a slowdown in key overseas markets.

NCL operates out of its three manufacturing facilities located at Mahape, Navi Mumbai in Maharashtra and Dahej SEZ, Bharuch as well as Karakhadi, Vadodara in Gujarat. In May 2023, the company acquired a 100% stake in BuLi Chem, which operates out of one manufacturing unit located in Hyderabad and has now become a wholly owned subsidiary of NCL.

The company has doubled its inorganic chemicals manufacturing capacity from 1,200 mt to 2,400 mt through greenfield expansion at the Dahej SEZ. Likewise, the Phase I and II expansion of the organic chemicals reactor has also been completed via the brownfield route across its different facilities. As a result, its own capacity now stands increased from 1,54,000 litres to 4,07,000 litres. Of its 60 m3 capacity, 31 m3 has already been commissioned till Q3 FY23 and the remaining 29 m3 will be commissioned during FY25, depending on demand.

A year earlier, the company signed an agreement with MU Ionic Solutions Corporation, Japan (MUIS) to acquire a manufacturing technology licence for electrolytes in India. NCL will pursue this through its 100% subsidiary, NeogenIonics Ltd. The land acquisition of 2,64,285 sq m has been completed recently at Pakhajan, Dahej PCPIR, Gujarat, and the plan is to establish a world class state-of-the-art battery material facility. This 65-acre greenfield site will be its largest facility dedicated solely to battery materials and new future business opportunities.

The 30 KTA electrolyte plant will be set up by using MUIS Japan’s technology whereas the 3,000 mt electrolyte salts and additives plant will be based on Neogen’s own indigenous technology. The company expects to start plant construction by April 2024 and make it operational in the second half of FY26. Dr Harin Kanani, Managing Director, said, “Aggregate capex for all these capacities, set to come online in FY24 and beyond, will be close to Rs 1,500 crore and will translate into peak revenue potential ranging from Rs 2,500-2,950 crore, depending on lithium prices. Once operational, these projects will drive us into a rapid growth trajectory in the sunrise sector of lithium-ion battery materials, leveraging our first-mover advantage over competitors.”

Expressing his enthusiasm, Dr Kanani added, “Our aim is to become the most dependable player by maintaining consistent product quality and ensuring timely supply. This will establish subsidiary Neogen Ionics as the market leader for electrolytes in India for EV applications.”

Detailing the schedule of commissioning the projects, Dr Kanani said, “In the new capacity of 400 mtpa for lithium electrolyte salt and additives, trial production has already commenced stagewise, and final checks and tests are going on. Customers’ approvals are expected to come through by the end of FY24 and revenues will come in early Q1FY25. The 2000 mt electrolyte manufacturing facility at Dahej is also scheduled for commissioning by the end of Q4FY24.” Dr Kanani added,” We propose to expand our lithium electrolyte salts and additive capacity at Dahej SEZ to 2,500 mt in phases, and it will be operational during FY25 to cater to the immediate demand for these particular products in the international market.”

In another development last year, NCL acquired 100% shares for Rs 25 crore of Hyderabad-based Buli Chem, a subsidiary of Livent USA Corporation, which is into the manufacture and supply of N-butyl lithium. This technology is a key reagent for the lithiation reaction used in the creation of complex pharmaceuticals and agrochemicals. Buli Chem had reported a revenue of Rs 65.28 crore during 2021-22. Dr Kanani had then said, “With our proprietary technology using highly reactive lithium metal, we can produce N-butyl lithium and other organo lithium derivatives in-house, along with our ability to recycle lithium. This gives us a strong competitive advantage in developing pharmaceutical intermediates and CSM projects.”

At the Q3 earnings conference, Dr Kanani had remarked that “after a brief period of six months of low demand, Buli Chem’s customers are now starting to consume N-butyl lithium on a regular basis. Going ahead, it will increase as now we are able to onboard new customers in India as well as in the international market on top of the existing customers of Buli Chem.”

The company has raised Rs 478 crore in a span of less than two years via the preferential allotment route to institutional investors. In January 2022, it raised Rs 225 crore by issuing 16,04710 shares of Rs 10 each @ Rs 1,402.12 (premium Rs 1,392.02) to three entities — SBI Mutual Fund, Axis Mutual Fund and Plutus Wealth Management LLP

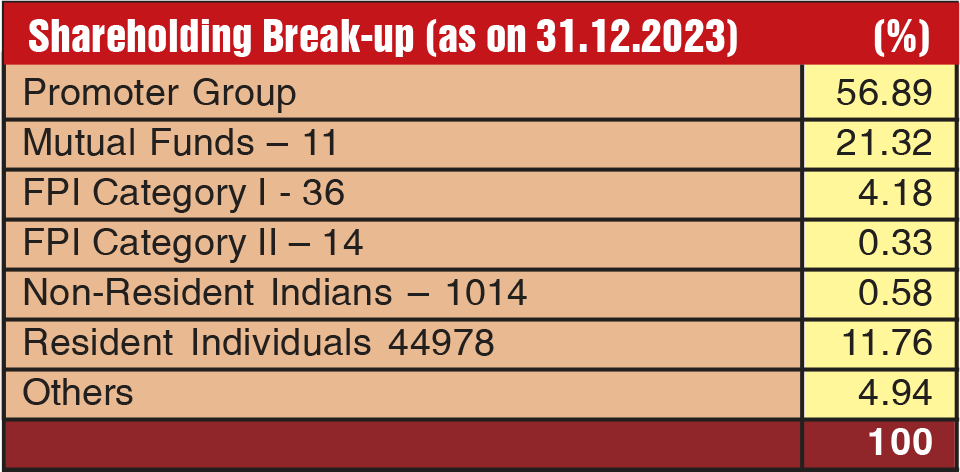

Again, in November 2023, Rs 253 crore poured via the issue of 14,42,358 equity shares @ Rs 1,754.07 (premium Rs 1,744.07) to seven entities — SBI Mutual Fund, Quant Mutual Fund, Tata Mutual Fund, India Acorn Fund, Invesco India, Ashoka India Equity Investment Trust PLC and Alchemy LT Ventures Fund. As a result, NCL’s equity capital has now increased to Rs 26.38 crore. The promoter group holds a 56.89% stake and the remaining 43.11% is spread among 47,006 public shareholders. At the current market price of Rs 1,193, the company is being valued at around Rs 3,147 crore.

During the first nine months ended December 2023, the company reported consolidated revenue of Rs 491 crore (+ 2%), EBITDA of Rs 74.7 crore (- 6%), PBT of Rs 30.3 crore (- 40%) and PAT of Rs 18.7 crore (- 47%). The EBITDA and PAT margins have been at 15.1% and 3.8% vis-à-vis 16.4% and 7.4% respectively during the same period in FY23. As a result, the EPS also witnessed a downside of 48% at Rs 7.41 against Rs 14.29. For the full financial year ended March 2023, revenue and net profit were Rs 686.18 crore and Rs 50 crore respectively.

Recently, NCL’s credit facilities worth Rs 725 crore have been downgraded by ICRA. The long-term facilities have been accorded ‘A-’ from ‘A stable’ and short- term from ‘A2+’ to ‘A2’.

Looking at the issue price of its two preferential allotments at Rs 1,402.12 and Rs 1,754.07 respectively in Jan 2022 and Nov 2023, the current market price of Rs 1,193 certainly looks attractive, especially because the stock is available nearly at its yearly low of Rs 1,149. Investors with a horizon of over one year are advised to start accumulating the stock for handsome returns.

The growth potential is enormous for the company. However, its ability to exploit better capacity utilisation with a good product mix, supported by an average EBITDA margin of around 18-20%, could become a key growth driver.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives