Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: February 15, 2024

Updated: February 15, 2024

Is it the end of the road for the fairytale success story that was Paytm? Following the RBI's fiat to Paytm Payments Bank to stop all business activities, including deposits, prepaid instruments, wallets and FASTags, after February 29 (now extended by a fortnight), not only Vijay Shekhar Sharma the poster boy of the fintech revolution but also millions of customers and merchants across the country are jittery, and many are already switching to other payment options.

According to industry sources, the RBI action was long overdue as Paytm Payments Bank was guilty of persistent non-compliance, among other things, with KYC regulations. Paytm's ultra-ambitious founder, Vijay Shekhar Sharma is now set for a fall that is as precipitous as his rise was phenomenal.

In his desire to emulate 'mentors' like Alibaba's Jack Ma, he lost sight of the fact that India's financial watchdogs have sharpened their oversight in recent years. But even as the ED has entered the picture, some reprieve is at hand with former SEBI chairman M Damodaran in assistance mode on compliance norms and Axis Bank prepared to run payments operations for Paytm. Though Paytm will not die, it will not remain the same.

After the Reserve Bank of India, the country’s central bank, administered a fatal body blow to One97 Communications by prohibiting its associate company Paytm Payments Bank from, for all practical purposes, doing any business, obvious questions have started doing the rounds in trade, business and market circles. Will Paytm survive? Will the country’s largest mobile payments company, which has contributed immensely in spreading the digital commerce culture in India, go the way of the dodo? Will Vijay Shekhar Sharma — the fintech whizkid and innovator, who tripped over a regulatory road hump in focusing more on rapid growth — rock again? Will the shareholders who were allotted shares at a price of Rs 2150 at the time of the IPO be able to recoup the massive slide in their investment?

Millions across India are keenly awaiting answers to these qustions. After all, Vijay Shekhar Sharma, a big name in the world of financial technology, succeeded beyond anyone’s wildest dreams in making Paytm a household name in the country. Son of a school teacher and hailing from a small town near Aligarh in UP, Mr Sharma created fintech history by building India’s biggest mobile payments company. Little wonder that he is often clubbed with other wunderkinds such as Bhavish Agarwal of Ola and Ritesh Agarwal of OYO, as a young technocrat-entrepreneur who became a tremendous success practically overnight.

Sharma’s success story started in 2001 when he set up One97 Communications. The new company got its first client in Bharti Airtel, which ordered a package consisting of astrology services, SMS-based auctions and music-related applications. “It was a difficult period and we had to work very hard,” reminisces Mr Sharma who had a passion for learning new technologies while working hard to expand his business. Hard work and his strong determination paid rich dividends, and within the next seven years services by One97 Communications were reaching 97 per cent of the country’s mobile subscribers, cornering around 25-30 per cent marketshare.

But Sharma was aiming even higher. He wanted to rock India’s fintech sector. Like his friend and mentor Jack Ma (co-founder of Alibaba of China), he was looking to take on the big guys like Amazon and Flipkart. With these high hopes, in 2009 he launched Paytm as a prepaid mobile and DTH recharge platform, and went on to add bill payments, ticketing and e-commerce. Comments an observer, “Sharma was trying to build the Alibaba of India.”

The observer adds, “Inside his four-storey office in Noida-UP’s Sector 5, Sharma used to have a sign on the glass wall of a conference room, which read, ‘Go big or go home’. Among his quotable quotes was: “One million orders a day will happen here first. That is our view our game.” And he worked hard to achieve his own target. Paytm grew phenomenally when it stepped into the wallet business in 2015. Its registered user base grew exponentially from 11.8 million in August 2014 to 104 million in August 2015. That was also when he meet Jack Ma for the first time and Ant Financial, a subsidiary of Alibaba, bought a stake in Paytm. Ma was followed by legendary investors Warren Buffet and Masayoshi Son, and even Tata group supremo Ratan Tata backed Sharma’s ‘baby’.

Sharma started building his business at a time when entrepreneurship wasn’t easy for a fresh college passout who could not speak fluently in English and had no financial backing. In an interview to Bloomberg in 2019, he had said, “If you build in India, you can go build anywhere in the world. What do you think is the first thing an Indian kid learns? That the bus stop is not where the bus will stop.” Sharma was right (then) because he was talking about the ‘old’ India where pretty much nothing worked the way it was supposed to. But today, when the regulator has clamped down on Paytm after a long period of warnings and discussions, the regulatory ‘bus’ seems to have stopped where it is supposed to stop.

It was the last day of the first month of the new year 2024 - January 31 -- when the an unexpected bombshell hit the company in the form of the RBI 'cease and desist' order. Not only Paytm and its MD and CEO, the entire urban population of the country was stunned. The RBI placed severe restrictions on Paytm Payments Bank, an associate company of One97 Communications, saying the regulatory fiat was warranted by persistent non-compliances and continued material supervisory concerns vis-à-vis the bank. The regulator found major irregularities in KYC practices, which exposed customers, depositors and wallet holders to serious risks. The regulator found that in thousands of cases, the same PAN was linked to more than 100 customers. The total value of transactions running into crores of rupees was much beyond the regulatory limits in minimum KYC prepaid instruments, raising money-laundering concerns.

The RBI directed Paytm Payments Bank to stop accepting deposits, credit transactions or pop-ups in customer accounts, pre-paid instruments, wallets, FASTags and NCMC cards after February 29, 2024, other than any interest cashbacks or refunds. It also ordered PPBL to settle all pipeline transactions and nodal accounts by March 15, 2024. In fact, Mr Sharma's fortunes had started declining from 2021, after reaching unprecedented heights of success. When One97 Communications entered the capital market to raise $ 2.4 billion, the IPO was the biggest-ever public issue till then as the company was valued at $ 2 billion.

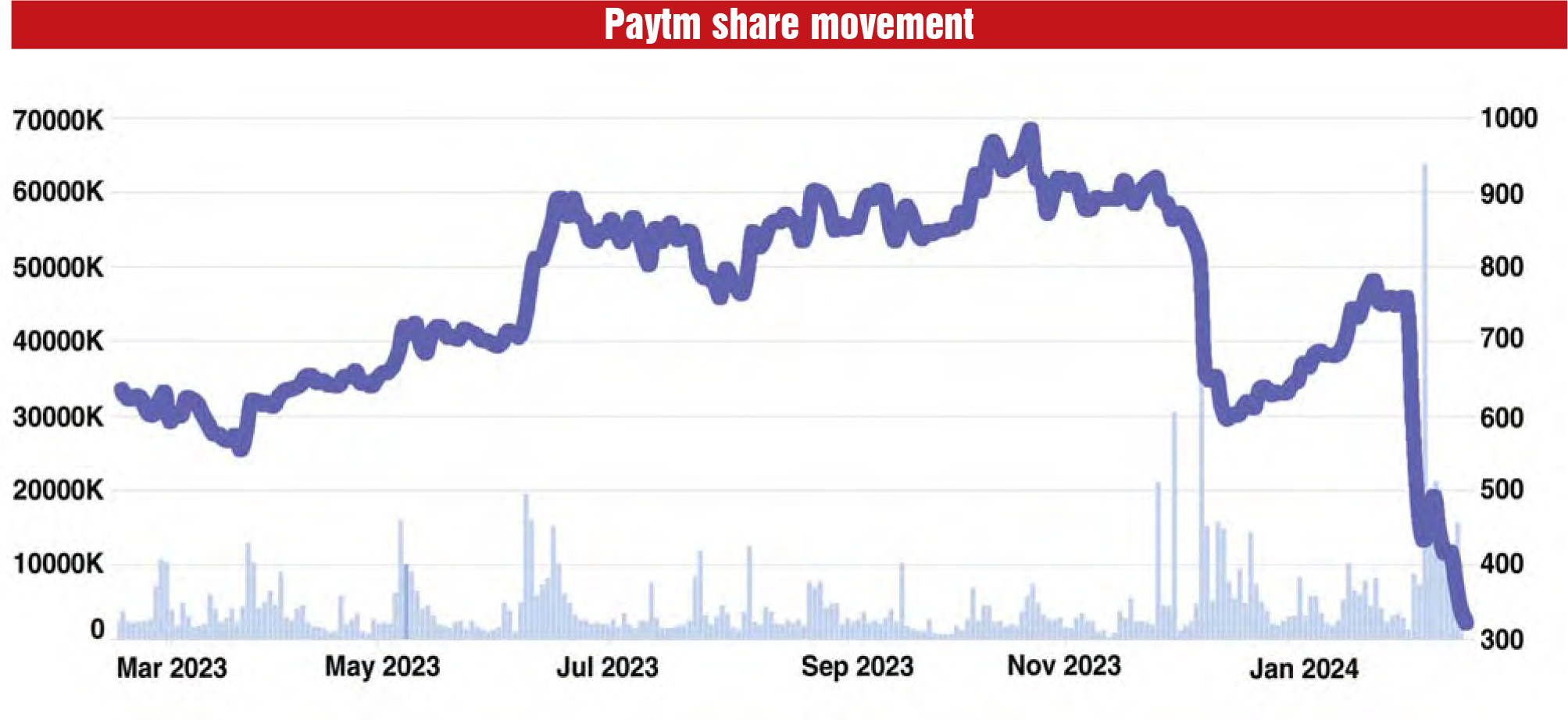

. The issue price was also kept at a skyhigh level of Rs 2,150 for a stock with a face value of Re 1. Unfortunately for Mr Sharma, India's biggest-ever IPO saw the biggest-ever crash in prices on listing day. On the very first day, the market price nosedived by more than 27 per cent as there were no takers at around Rs 1,560 against the issue price of Rs 2,150. The shares plunged as many investors believed that the valuation of the company was too high in the context of its lack of profit. Ever since the IPO fiasco, Paytm was struggling with one issue or other.

Comments an analyst, "Unlike its traditional peers, the banks proper, which would move with alacrity and great deliberation, new-age fintech companies like Paytm were less strictly regulated and were driven by a desire for phenomenal growth instead of meticulously following regulations. Piling up big numbers is necessary to impress investors, while profitability can wait. Growth in the startup universe often means attracting big investors instead of charting a clear path to profitability. Sharma's Paytm was not too isolated from the prevailing trends."

However, despite Mr Sharma's assurances, the company continues to be in the red. During the last eight years, though revenues have expanded from Rs 449 crore in fiscal 2016 to Rs 6,028 crore in fiscal 2023, the company has remained in the red with Paytm incurring a loss in operating profit of Rs 1,720 crore in fiscal 2016, which rose to Rs 4,114 crore in the 2019. Though the loss reduced to Rs 2,296 in 2022 and further to Rs 1,701 crore in 2023, the balance sheet remains in the red even after business was growing at a fast pace.

Little wonder that in 2022, three proxy advisory firms - Institutional Investor Advisory Services, India (IIAS), InGovern and Stakeholders Empowerment Services -- advised shareholders to vote against the reappointment of Mr Sharma as CEO and Managing Director. IIAS said in its note to shareholders: "Vijay Shekhar Sharma has made several commitments in the past to make the company profitable. However, these have not played out. We believe the board must consider professionalizing the management."

Though shareholders, ignoring IIAS advice, voted for Mr Sharma, concerns over profitability and lack of remedial action by Paytm did not go away. In March 2022, after months of engagements and Paytm's inability to take remedial action, the regulator barred the payments bank from onboarding new customers. Dissatisfied with the company's response to the issues raised by it, the RBI regulator has now moved to clip its wings by prohibiting PPBL from, for all practical purposes, doing any business. Obviously, this regulatory sledgehammer that has fallen on Paytm will adversely affect the company's business and erode its credibility. Stunned investors have rushed to unload their holdings, hammering down the stock price to Rs 325, which has eroded 85 per cent of the wealth of investors who had subscribed to the IPO.

A stunned Mr Sharma reportedly approached Union Finance Minister Nirmala Sitharaman, who advised him to meet the RBI Governor to sort out the issue. And rumours started doing the rounds that RBI was going to ease the curbs. But RBI Governor Shaktikanta Das made it clear that "there will be no review of the curbs on Paytm." Pointing out that "we take all decisions after a lot of discussion, after much consideration, after much pros and cons and the angularities," Mr Das added that "it is done after discussion with the regulated entity - sometimes these discussions go on for months, at times for two-three years, with any regulated entity. We act when we don't see effective action." Insisting that "RBI has always supported fintech and sought to encourage its growth, and it wants it to grow," Mr Das added, "The fintech sector has a very crucial role because it has lakhs and crores of customers. Customer interest and financial stability are of prime importance. In a regulated environment, you have to follow regulations to run your business."

Unnerved by the RBI's strictures and the stern stand of the RBI governor, cautious investors have rushed to unload their holdings, including even Alibaba of Jack Ma. Foreign brokerages, including CLSA, Morgan Stanley, Jefferies, Bernstein and Macquarie, have downgraded One97 Communications and slashed its target price by 20-65 per cent from the levels set earlier. Though both Indian stock exchanges placed lower circuits almost every day, the share price has continued to slide. The share price, which had tumbled from the issue price of Rs 2,150 to Rs 998.30 in October 2023 (52-week high), crashed 66 per cent, with most of the losses recorded since RBI slapped severe restrictions on the PPBL on January 31. Since that day, Paytm shares have shed more than half their value, tanking around 53 per cent.

The question making the rounds is whether Paytm will survive the RBI bombshell. As soon as the RBI's fiat became public knowledge, investors rushed to offload their resigned. Hundreds of thousands of merchants stopped accepting Paytm payments, while predators await a chance to grab a goldmine which has been losing its value in the market a day after January 31. The names of Jio Financial Services of Mukesh Ambani and HDFC Bank are being floated. As one commentator remarked, "Which ambitious entrepreneur would not be willing to grab such a wonderful project if available?" To the common public, it looks like the end of the the era of Paytm, while experts wonder how Paytm will survive without Paytm Payments Bank.

However, Mr Sharma is not one to give up so easily. Admitting that the RBI step is "more of a big speed hump," he has said, "It is something that we believe that, with the partnership of other banks and the capabilities that we have already developed, we will be able to see through in the next few days or quarters as the case will be." Maintaining that the RBI strictures on Paytm will have an impact of Rs 300-500 crore on the company's annual operational profit, a spokesman of One97 Communications hoped the company will stage a comeback soon, adding, "We will transfer all PPBL accounts to other banks." However, some banking experts are pessimistic about the company's survival, noting that "this is easier said than done. If hundreds of thousands of merchants are asked to move their accounts from PPBL to another bank, Paytm will likely lose the credibility and confidence of these merchants." As another expert quips, "If the RBI continues to maintain a harsh approach to Paytm, how many banks will agree to join hands with Paytm?"

However, in the face of these odds, One97 Communications has insisted that "our management is committed to driving sustainable business growth while adhering to a regulatory and compliance framework." And in order to strengthen these compliances, the company has formed a panel headed by none other than Meleveetil Damodaran, former Chairman of the Securities and Exchange Commission of India (SEBI). The Damodaran panel will work with the board of One97 Communications for strengthening compliance norms as the company battles the central bank's regulatory strictures. Those who know Mr Damodaran well believe that the appointment of the veteran regulator and financial expert is a masterstroke by Mr Sharma. There cannot be any better financial counsel in the circumstances than Mr Damodaran, who can advise the Paytm board on bolstering compliance and regulatory measures. The former SEBI chief has extensive experience in corporate governance, restructuring and regulatory matters. Previously, he has chaired high-power committees for the government of India and the RBI. The choice of Mr Damodaran's leadership indeed indicates Paytm's commitment to robust governance practices. Mr Damodaran is certainly capable of helping Paytm navigate regulatory challenges effectively.

After the RBI bombshell, the Enforcement Directorate (ED) too has entered the scene and has initiated a preliminary inquiry into the operations of PPBL. Of course, it has not yet filed any enforcement case information report. Thus, at present the RBI and ED are investigating the Paytm matter. Though battered and bruised by the RBI fiat, Paytm has agreed to cooperate with the regulatory agencies and to comply with requests for information from the agencies. Does the RBI dropping the hammer on PPBL mean the end of the story for Paytm? "Certainly not," says Mr. Sharma. The poster boy of India's fintech boom has assured users that the digital payments and services app will continue to operate without disruption beyond February 29 (and now beyond March 15), the RBI deadline for inactivation of Paytm Payments Bank

Moreover, within a fortnight, the troubled fintech has won a reprieve from a commercial bank. According to an arrangement between Paytm and Axis Bank, the latter will run payments operations for the Paytm network. The pact between the two entities will help Paytm weather the regulatory storm. This means that Axis Bank will step in to replace PPBL as the backbone for the merchant payments settlement business of Paytm. Does this mean that Paytm will be the same again? No. The replacement of the bank will allow Paytm to continue its business, but because of the absence of its own payment bank, Paytm will lose its differentiation with rivals like Phone Pe and Google Pay. In other words, Paytm will have to accept a more level playing ground and will lose its earlier exclusivity. However, on the plus side, the share price which had tumbled to Rs 325 has stopped going down further and has started finding support at the current all-time low level.

Again, the entry of Mr Damodaran is a major factor in favour of Paytm as he is capable of transforming Paytm into an excellent player in terms of corporate governance and regulatory compliance by respecting all the rules and regulations of the country. This is the time to wait and watch. Merely drawing conclusions from the RBI's strictures are not that important here. What needs to be seen is how the outcome of the ED's investigations impacts Paytm's future (see Editorial).

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives