Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: February 15, 2023

Updated: February 15, 2023

The railways sector has of late emerged as one of the most happening segments of the Indian economy, and has become even more attractive after the Union budget for 2023-24 allocated Rs 2.4 lakh crore as the capital outlay for its development. Viewed in this context, we have selected another rail company, after Titaghar Wagons, as the Fortune Scrip and it is TREL which is one of the largest players in the manufacturing of railway wagons. The company has a diversified product basket comprising railway freight cars, hydro-mechanical equipment, industrial structures, steel castings, loco shells, electrical-mechanical units (EMU), railway bridges and pressure vessels.

railway freight cars, hydro-mechanical equipment, industrial structures, steel castings, loco shells, electrical-mechanical units (EMU), railway bridges and pressure vessels. Texmaco Rail is a multi-discipline, multi-unit engineering and infrastructure company with 5 manufacturing units extending over 170 acres on the outskirts of Kolkata. The company was formed in 2010 after its merger with the heavy engineering and steel foundry divisions of parent company Texmaco Ltd, a textile machinery manufacturing company founded in 1939 by renowned industrialist KK Birla. Texmaco Rail and Engineering became the flagship company of the Adventz group headed by Saroj Kumar Poddar. Subsequently, it acquired Kalindee Rail Nirman Ltd and Bright Projects Ltd, which strengthened its rail EPC offerings. While Kalindee Rail was merged with Texmaco Rail, Bright Power was converted into its subsidiary. An EPC company, Bright Power specializes in overhead electrification solutions for the railways. Thus, Texmaco Rail is a total rail solutions provider and is well-positioned to leverage growth opportunities in railways infrastructure.

With a view to growing in size, Texmaco Rail formed a joint venture with UGL Rail Services, Australia, styled Texmaco Hi-Tech Pvt Ltd, which set up a state-of-the-art manufacturing facility to cater to the huge requirements of locomotive wagon and coach components for the Australian market through UGL. However, this development did not work, and, as a result, Texmaco Rail had to develop its own customer base and take steps for getting registered, qualified and credited for acceptance of trial orders, and succeeded in satisfying its customers and getting regular orders. The company also started getting orders from Indian Railways. This success enabled the company to become more broad-based, and currently the JV is targeting long- duration projects which require hi-precision, hi-tech manufacturing capabilities.

The company's second JV was formed with Wabtec Corporation, an American company founded by the merger of Westington Air Brake Company and Motive Power Industries Corporation. Initially, the JV will provide hi-tech freight corridor services and other state-of-the-art railway products to the Indian Railway network. A new manufacturing facility has been set up in the Emelgharia area of Kolkata to produce Wabtec's leading global product lines in freight and locomotive brake shoes, truck mounted brakes, and cushioning systems. Subsequently, Texmaco Rail has formed a joint venture with Touax Rail, a lessor of intermodal freight railcars in Europe and the US. The JV has been formed to enter the business of wagon leasing.

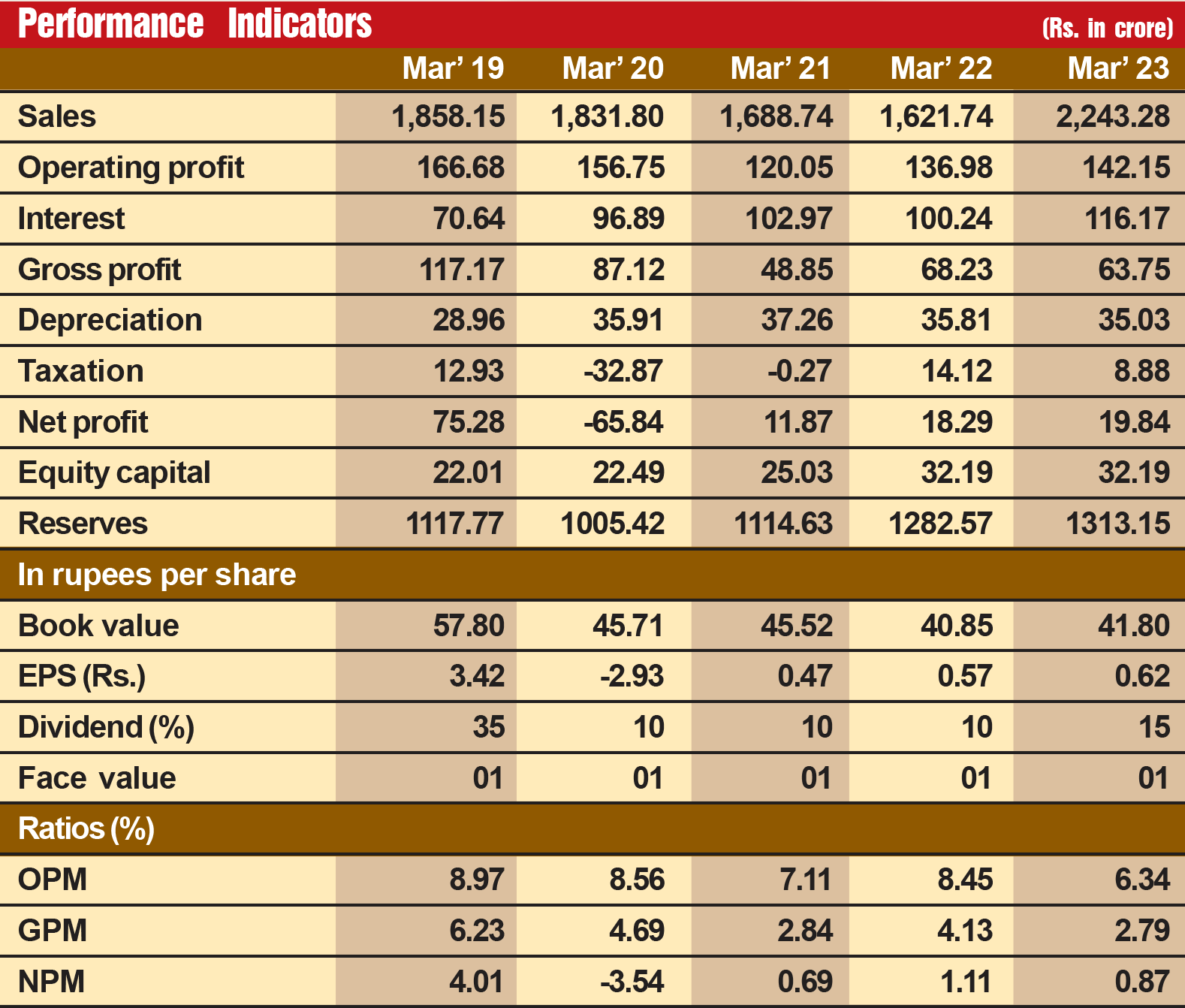

The company has made steady progress in its financial performance. During the last 12 years, its sales turnover has more than trebled from Rs 767 crore in fiscal 2012 to Rs 2,600 crore in fiscal 2023. Operating profit, which had gone down from Rs 134 crore in fiscal 2012 to Rs 60 crore in fiscal 2018, has picked up again to reach Rs 142 crore in fiscal 2023, and net profit, which had slumped from Rs 93 crore in FY2012 to a loss of Rs. 60 crore in FY2020, will once again reach the Rs 93-crore level this year, indicating that the worst is over and the company is on a growth trajectory. Its future prospects are highly promising. Consider:

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives