Fortune Scrip

Published: January 15, 2023

Updated: January 15, 2023

Newgen Software Technologies

Small cap IT stock with big future

After the excellent and widespread response to our selection

of a small cap IT stock (K Solves India) as the

Fortune Scrip last month, we have come across another

small cap IT stock which is not only doing well at present

but has tremendous growth prospects. It is Newgen Software

Technologies, which we had recommended over a

year ago to buy at a price of Rs 300. Today, it is quoted

around Rs 1,600 after the company announced a bonus

issue in the liberal ratio of 1:1. We strongly feel that there

are better days ahead for the company and its shareholders.

Newgen Software is a leading united digital transformation platform provider with native process

automation content services and communication management capabilities. The company is

known for simplifying the most complex business processes of customers by combining the power

of process automation, content services, customer engagement and intelligence. Continuous innovation

runs deep in its product philosophy, helping the management win over customers’ hearts

every time they think ‘digital’.

Little wonder, globally successful enterprises rely on Newgen’s industry-recognised low code

application platform to develop and deploy complex, content-driven and customer-engaging business

applications on the Cloud. The company provides on-boarding service requests, leading and

underwriting, among others, across several industries to support businesses in scaling up their

operations.

Newgen has been successfully certified/assessed for the ISO 9001-2015 certificate, the ISO

27001 20B certificate, and CMMi-2.0 for Dev level 3.

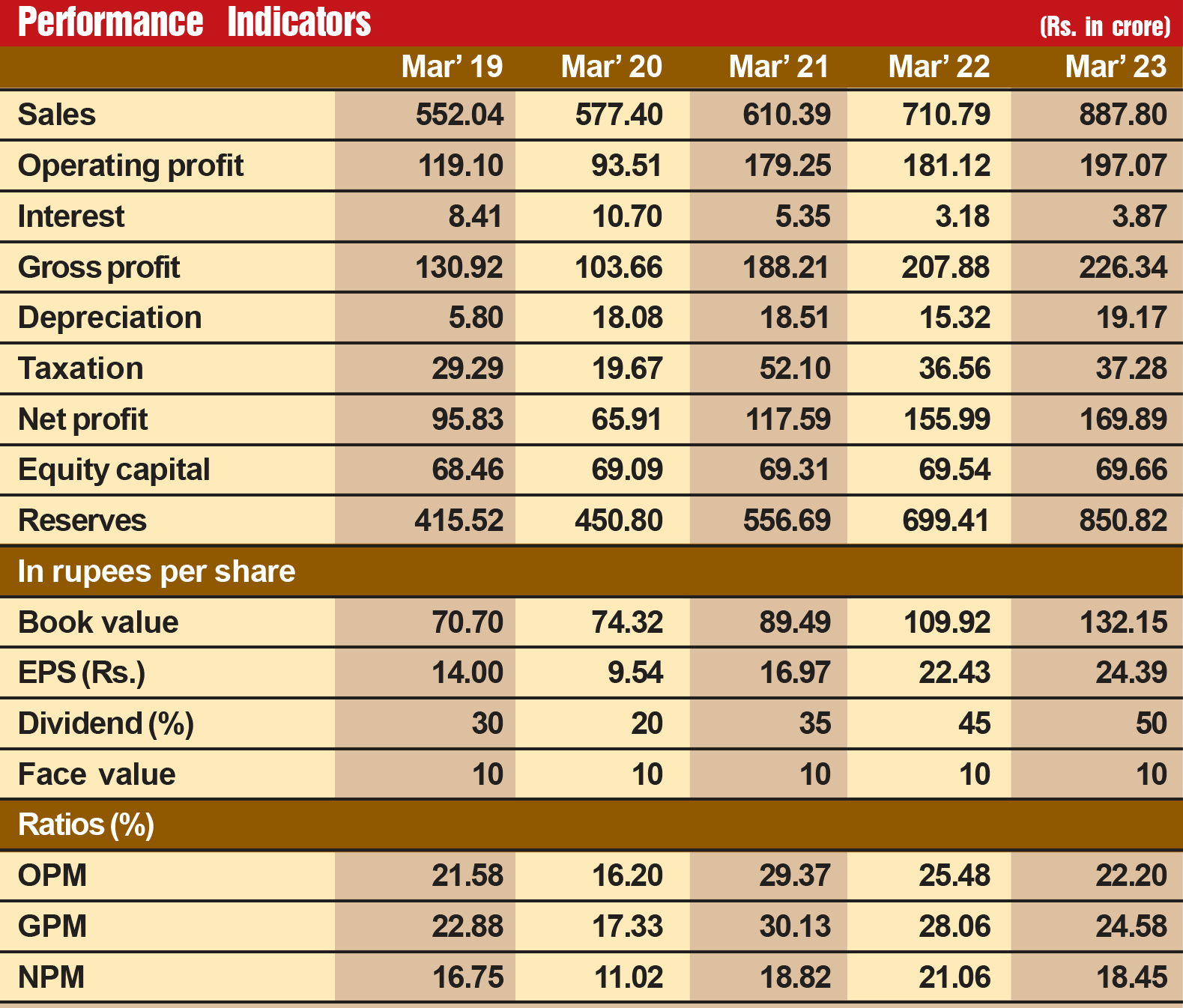

SALES BOOM

With growing recognition and spreading prestige, the company has been growing rapidly on the

financial front. During the last 12 years, its sales turnover has expanded more than six times from Rs

139 crore in fiscal 2012 to Rs 888 crore in fiscal 2023, with operating profit spurting around 20 times

– from Rs 20 crore to Rs 198 crore and the profit at net level shooting up over 12 times from Rs 14

crore to Rs 170 crore.

But we have not picked Newgen as the Fortune Scrip on the strength of its past laurels. Its future

prospects are all the more bright. Consider:

-

The company is on a sustained growth path. Well-known global brokerage Jefferies says,

“Newgen has adopted a vertical specific point-solution asset approach to enhance sales among existing and new customers. This should limit EBITDA margin expansion in the future. We thus

expect our 2024-26 margin to remain around the 22% range.”

-

Newgen’s stock performance returns are quite impressive. The stock’s 52- week high price

is Rs 1635.10 a piece and the 52-week low price is Rs 359 a piece respectively. Newgen shares gave

strong returns in the past few years. The shares gained 84 per cent in the past 3 months, soared 145

per cent in the last six months, rose 335 per cent in the last one year and gave a fabulous return of

487 per cent in the last 3 years. This growth trend is expected to continue going ahead.

E.P.S. SPURT

-

Of late, the company is achieving its growth of earnings per share at a very impressive rate.

During the last five years, its EPS has grown from Rs 9.42 in fiscal 2020 to Rs 16.20 in FY2021 and

further to Rs 22.29 in FY2022 and Rs 24.28 in FY2023. This EPS growth rate is something the company should be proud of. After all, generally a share

price follows the trend in EPS. Investors always love to pick stocks whose EPS is on the rise.

-

The company management’s attitude and policy are investor-friendly. Since 2018, it has

been regularly paying dividends, the rate for the last fiscal year; i.e., 2023, being 50 per cent. What

is more, this year the company declared a bonus issue in the liberal ratio of 1:1. The company’s

financial position is sound, with reserves at the end of March 2023 standing at Rs 851 crore – over

20 times its equity capital of Rs 70 crore. Its borrowings are negligible — just around 3 per cent of its

sales turnover — and the company will soon be a totally debt-free entity. Global brokerage Jefferies

which gave a ‘BUY’ call with an increase in the target price to Rs 1,740 (from its earlier target of Rs

1,275), commented, “We are more confident on Newgen’s growth outlook and raise our revenue

estimates by 2-3 per cent and our EPS estimates by 3-4 per cent. We expect Newgen to deliver a

strong 26 per cent EPS CAGR over FY2024-26.”

-

At the last annual general meeting of the company, the management projected a strong

growth outlook for Newgen. This strong growth will be driven by India and the Middle East, especially

since India is witnessing strong traction. Thus, the company has no fears of an adverse impact

of the expected recessionary trends in the US and Europe.

BIGGER DEALS

-

The management has revealed that the company has attracted deals, the size of which is

increased by around 40 per cent in the last year driven by strong demand, more comprehensive

solutions and the ability to tap into tier-I accounts. The company’s trade finance product has had

large deal wins and provides strong growth visibility going ahead.

-

Oman-based Development Bank has selected Newgen Software to simplify its banking

process and provide enhanced experiences. The bank — the financing arm of the Government of

Oman — entered into partnership with Newgen as it wanted to focus on supervising the entire

content life cycle, from origination to disposition. This partnership is a prestigious feather in the cap

of Newgen and a recognition of its achievement in software development. Sizeable buying by investors on account of a bonus issue and a higher dividend, among others,

has led to the share price of Newgen shooting up to Rs 1,600, which is a cum-bonus and cumdividend

price. As the company’s future prospects are highly promising, it is advisable to include

these shares in the investment portfolio of every discerning investor. Of course, the best course is to

accumulate at every decline, if any.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access