Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: July 15, 2024

Updated: July 15, 2024

Consumers will not be pleased by the 15-25 % tariff hike by the country's telecom companies, but it is a necessary evil to maintain the growth of the crucial sector, which contributes around 10 per cent to the country's GDP.

Apart from its economic impetus, which includes bringing in muchneeded FDI, the industry has been a driver for socio-economic change via development, employment generation, and digitizing of essential services like education and healthcare

The sector is currently the second largest in the world with a subscriber base of 1.2 billion, but its pace of growth has not been helped by the fact that Indian telecom tariff are possibly the lowest globally.

With the need for ‘political correctness’ over after the recent general elections, the ‘Big 3’ of Reliance Jio, Bharti Airtel and Vodafone Idea lost no time in raising tariffs by 15-25 %, with the move expected to bring in additional operating profits of around Rs 20,000 crore for the industry. On the flip side, the tariff hike is likely to raise core inflation by 0.2 % this fiscal.

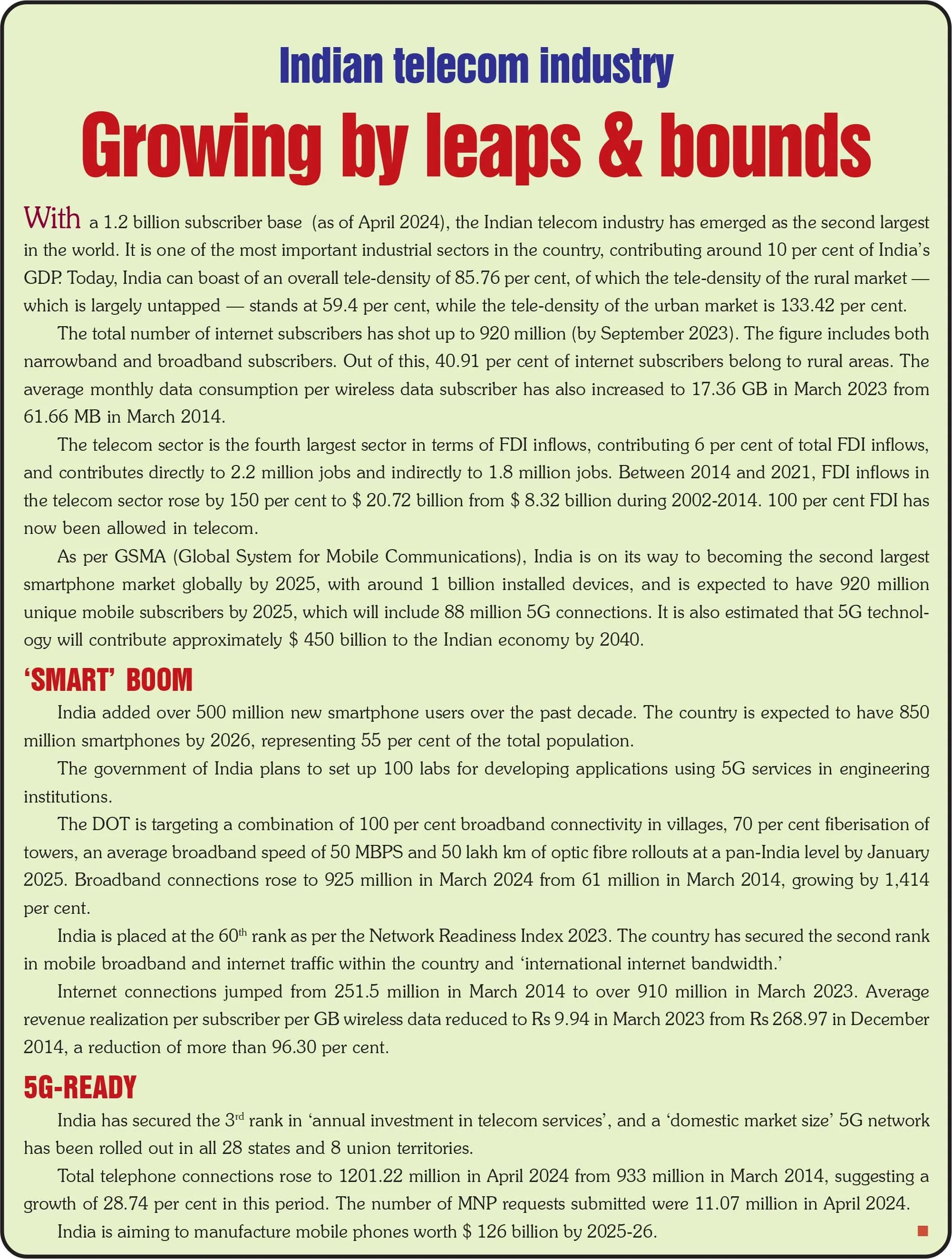

BUOYED by a 15-25% upward price revision, India’s Rs 1,00,000 crore telecom industry, which currently contributes around 10 per cent to the country’s GDP, is all set to a re-rating. The industry is one of the most important sectors in the Indian economy, and is instrumental in development, poverty reduction through empowerment of the masses, unlocking economic growth, employment generation, bringing in FDI (foreign direct investment), and digital transformation of essential services like education, healthcare and financial services.

The telecom sector has witnessed stupendous growth in the last few years and has by now emerged as the second largest in the world with a subscriber base of 1.2 billion (April 30, 2024) with both wireless and wireline subscribers. But of late, the pace of growth has slackened on account of declining revenue and dipping margins in the sector. With tariff rates in India being one of the lowest in the world, the easiest answer to solving this problem is by raising tariffs.

In the run-up to the recently concluded general elections, shrewd telecom operators bided their time, and as soon as the elections were over industry leader Reliance Jio announced a 15-25 % price revision, followed by Bharti Airtel and Vodafone Idea. Thus, the telecom trio that has a monopoly of the Indian telecom market have, as expected, hiked tariffs. Once these hikes are fully absorbed, they could result in additional operating profits of around Rs 20,000 crore for the industry.

Thanks to this tariff revision, mobile phone bills will shoot up by 15-25 % on existing plans. And the tariff hikes will push up core inflation by 0.2 % in the fiscal year ending March 2025, according to a foreign brokerage house. Analysts at Deutsche Bank upped their core inflation projections, excluding food and fuel, by 0.20 % to 3.8 %. According to a Deutsche Bank report, the impact of the telecom tariff hikes will start getting reflected from July and will on their own push core inflation by over 0.85 per cent month-on-month. Overall, core inflation will likely rise by 0.20 per cent in FY2025. Consequently, Deutsche Bank has revised its FY2025 core inflation forecast from 3.6 per cent earlier to 3.8 per cent now. The Reserve Bank of India, which is tasked with maintaining the number at 4 per cent, also expects fluctuations in the headline number during the course of the year.

Needless to say, telecom industry circles are jubilant over the tariff hikes which are considered highly positive for the industry. Says one expert, “The tariff hikes were much needed for all telecom players in order to sustain in the rising capex space.” Prashanth Tapse, Senior Vice President (Research) at Mehta Equities observes that after 2021, when tariffs were last raised, the telecom industry continued to suffer the pressure of high costs due to a low ARPU (Average Revenue Per User), and could not further revise tariffs for multiple reasons, which led to subdued growth in the sector during fiscals 2022 and 2023. What is more, even the spectrum auction held in June met with a muted response as telcos had no surplus funds. As a result, the government could collect only Rs 11,340.78 crore – the third lowest since competitive bidding began in 2010 from selling 141.4 units of airwaves.

Experts point out that the recent tariff hikes will prove highly positive for telecom players by way of 2G to 5G migration and increased data monetization, and the extra income will support ARPU growth for these players in the short run. This is bound to re-rate these companies in the stock market.

According to analysts, Reliance Jio and Bharti Airtel are expected to register a 16-18 per cent average revenue per user (ARPU) benefit from the hike in tariffs for prepaid and postpaid plans. Vodafone Idea is expected to be the biggest beneficiary with an 18-20 per cent ARPU.

The tariff hike will lead to Bharti Airtel's ARPU stabilizing to Rs 280+ levels by fiscal 2026 and at Rs 300 by FY 2027. Today, Airtel has the highest ARPU in the market at Rs 209, followed by Reliance Jio at Rs 181.7 and Vodafone Idea at Rs 146 at the end of the fourth quarter last fiscal.

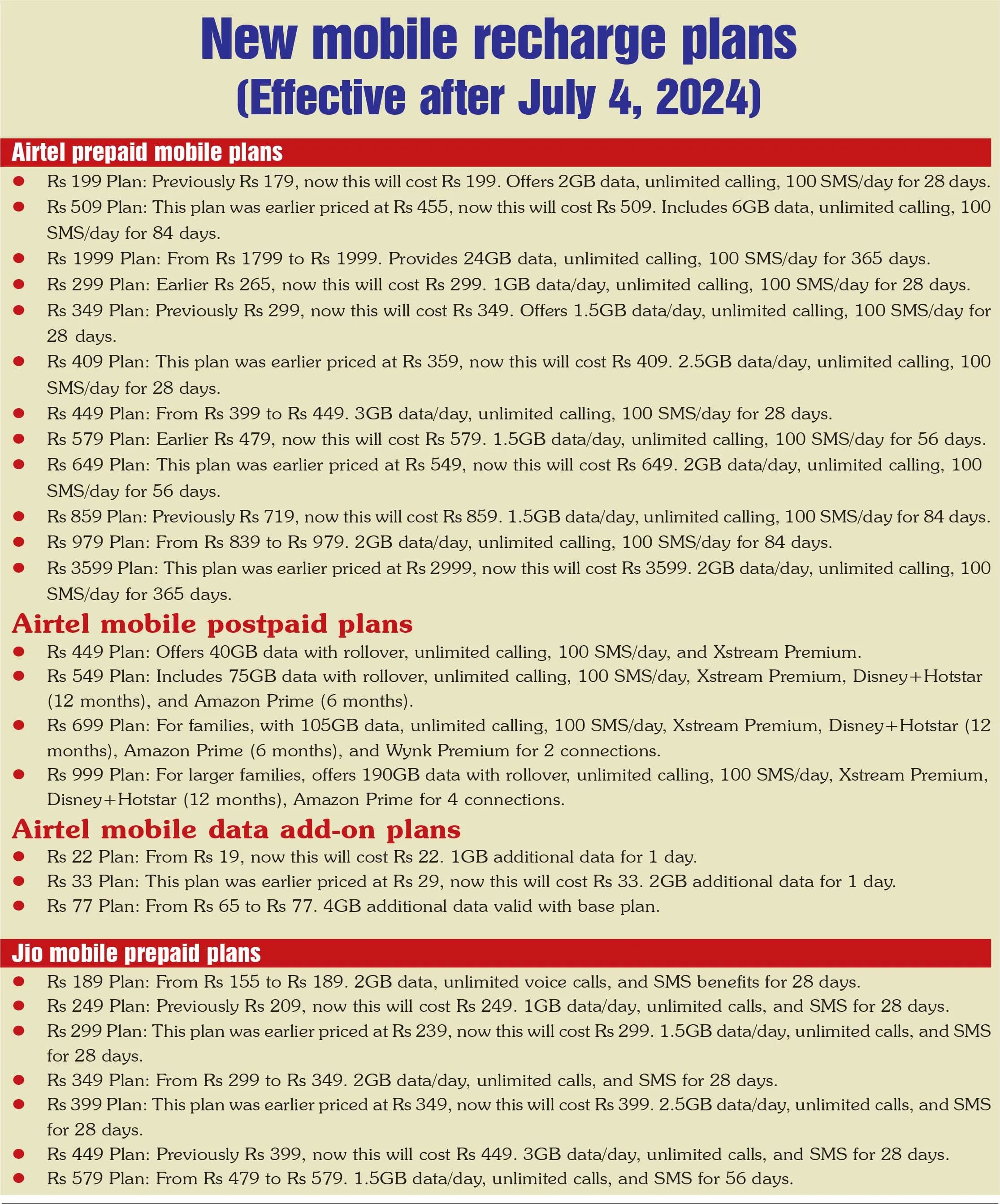

Reliance Jio announced on June 27 an increase in tariffs across segments, excluding feature phones, starting from base level prepaid monthly packs to annual packs in the range 13-25 per cent, while the hike in post-paid packs is in the 13-17 per cent range. Additionally, the minimum monthly plan required to avail unlimited 5G data has also been raised from Rs 239 to Rs 349.

Analysing the new Reliance Jio tariff plan, analysts at Nomura point out that Jio has raised its key lower-end monthly plans at a higher rate of 19-25 per cent, compared to higher-end monthly plans of 13-17 per cent. "This is a positive initiative to drive higher ARPU, given the existing subscriber mix," they say.

The erstwhile entry-level prepaid plan of Rs 155 has been raised by 22 per cent to Rs 189, and the Rs 239 plan has been hiked by 25 per cent to Rs 299, while the postpaid plans have been raised by 17 per cent and 13 per cent to Rs 349 and Rs 449 after no hikes in the previous two rounds. The entry level post-paid plans are now placed at Rs 349. Analysts at JP Morgan have observed that a 5G tariff hike will help Jio more in view of the higher 5G average and availability at three times that of Bharti Airtel.

According to analysts at BOFA Securities, "this round of tariff hikes would lead to improvement in telecom sector cash flows and return rates for all companies. Among the three companies, Vodafone Idea will emerge as the biggest beneficiary of this round of tariff hikes, as it is a pure play mobile operator, followed by Bharti Airtel and Reliance Jio."

If calculations by all these experts are analysed, it can be said that based on the tariff hikes, there will be an 18-25 per cent in EBITDA for Bharti Airtel and Reliance Jio for fiscals 2024 to 2026, along with a 500 bps ROIC improvement. With this tariff hike, Reliance Jio has taken the first step towards 5G monetization by raising the threshold for 5G data availability.

Jefferies analysts observe that Jio's limited participation in the spectrum auctions suggests that its focus on network monetization is rising, and its initiative on raising tariffs suggests that it is more confident that its subscribers are unlikely to churn out. The rising focus on monetization could also a precursor to its imminent listing.

It may be noted that Jio's 5G was earlier offered as free and unlimited across all data plans when the user had a compatible handset. This has now been shifted to users having to subscribe to plans which are 2GB per day and above.

Analysts at JP Morgan and BNP Paribas insist that this effectively drives a 46 per cent increase in tariff for Reliance Jio's 5G users.

According to Danish Khan, a telecom expert, "this round of tariff hikes will lead to SIM consolidation", but analysts add that the magnitude of the impact may be lower this time around compared to previous rounds of tariff hikes.

Adds Mr Khan, "Historically, we have seen some SIM consolidation and negative elasticity impact after tariff hikes. While anticipating a similar negative impact this time as well, we think the magnitude of the impact may be larger. SIM consolidation is already behind us and data is getting sticky, so much so that consumers may not downgrade as much."

According to Kotak Institutional Equities Research, the tariff hikes by the three top telcos (Reliance Jio, Bharti Airtel and Vodafone Idea) would impose an extra burden of Rs 45,700 crore annually on mobile plans.

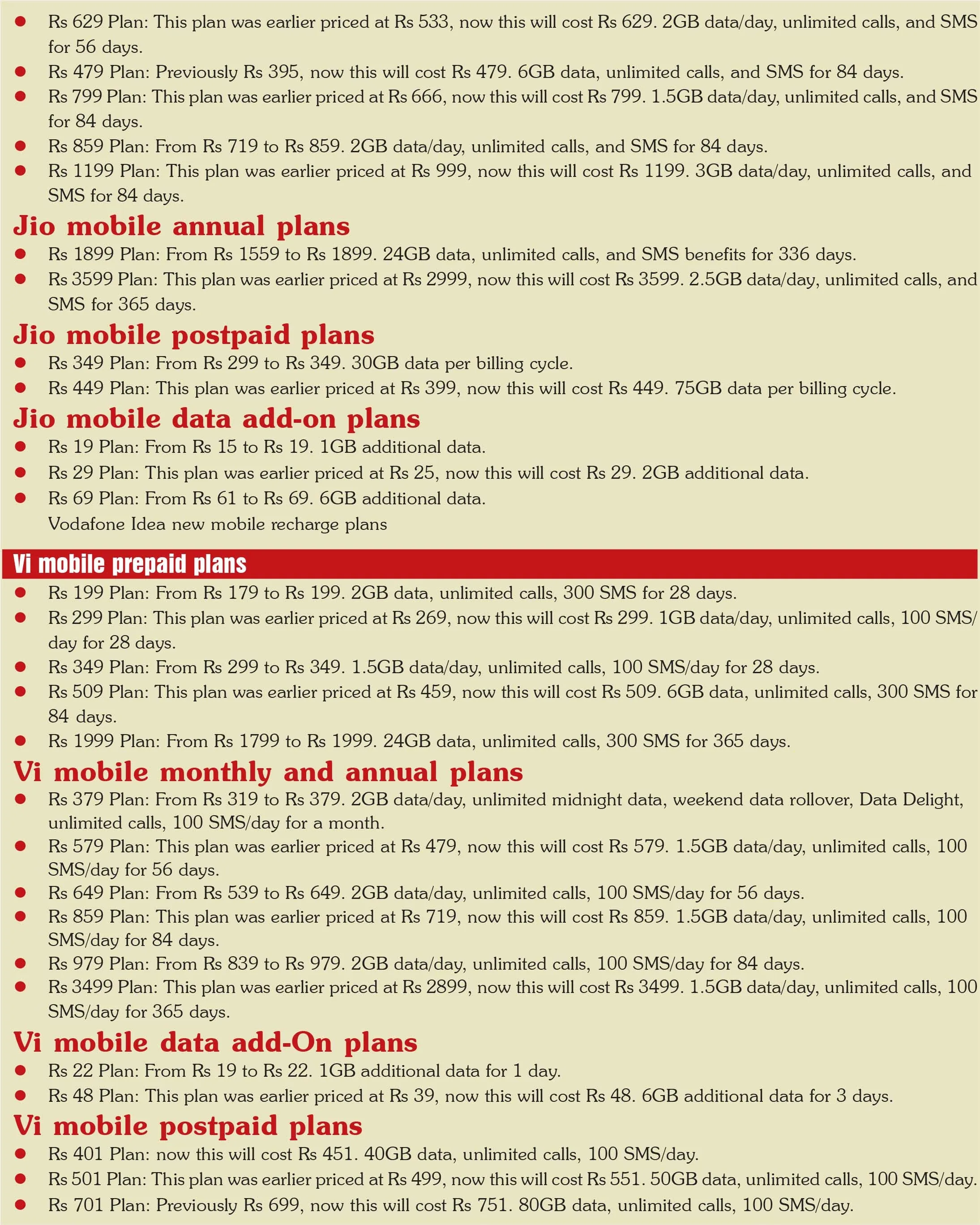

While Reliance Jio raised its prices by 13- 27 per cent, Bharti Airtel increased tariffs by 10-21 per cent and Vodafone Idea hiked its prices by nearly 10-23 per cent. A Jio user willing to get a 5G internet plan must now pay a minimum of Rs 349 for a 2GB per day recharge pack, as compared to the earlier Rs 239 data plan which gave them 1.5 GB per day. Likewise, an Airtel user willing to get a 5G data pack now has to buy a bigger-priced pack at Rs 409 which gives them 2.5 GB rate per day, as compared to the earlier Rs 239 plan which gave them 1.5 GB per day.

Ankit Jain, Vice-President and Sector Head (Corporate Ratings), ICRA Limited, stresses that the latest round of tariff hikes will provide traction in ARPU and can result in additional operating profits of around ?20,000 crore for the industry, once these hikes are fully absorbed.

This will result in increased profit generation, thereby providing headroom for the industry to undertake deleveraging and fund capex for technology upgrade and network expansion.

ICRA expects the industry revenues to grow by 12-14 % in FY25, which, given the operating leverage, is likely to translate into healthy expansion in operating profits by 14-16 %. This, in turn, will likely improve industry ROCE (return on capital employed) to more than 10 % for FY2025.

ICRA also expects the industry to report Rs 3.2-3.3 lakh crore in revenue with operating profits of Rs 1.6-1.7 lakh crore in FY25.

Another expert maintains that telecom companies are expected to grab an additional Rs 47,500 crore on account of this upward price revision. This financial bonanza will enable Reliance Jio, Bharti Airtel and Vodafone Idea to expand their 5G stations and enhance network load capacity to cater to the increase in consumption and creation of video content, besides strengthening the overall financial position of these companies. Naturally, the spurt in revenues due to this price rise will pave the way for re-rating of these companies on the stock market. Investment in these stocks will prove highly beneficial to investors in the medium- to long term.

Reliance Jio's strategy was to first attract customers by slashing rates, driving out a number of competitors in the market, and start raising the rates once the ground was clear and customers were happily habituated to Jio telecom services. The company has thus revised its rates upwards twice, in 2021 and in July 2024, testifying to its financial strength.

Experts believe the recent price escalation will pave the way for Reliance Jio to go public. According to Jeffries, a renowned global brokerage house, Reliance Jio Infocom may be spun off from the parent Reliance Industries sometime in 2025. At present, Reliance Industries holds a 66.3 per cent stake in Jio and post spun-off, RIL shareholders would receive their proportionate shareholding in Jio adjusted to RIL's 66.3 per cent holding. The balance stake is being held by Facebook (7.10 per cent), Google (7.7 per cent) and private equity investors (16 per cent). The company may come out with a bumper IPO (initial price offering) to facilitate an offer for sale by minority shareholders with a potential valuation over Rs 9.3 lakh crore. As per Jefferies, the listing of Reliance Jio may take place at a potential valuation of $ 112 billion (around Rs. 9.3 lakh crore), suggesting that it will be a behemoth issue.

Bharti Airtel, popularly known as Airtel, is a formidable global telecom communications solutions provider with over 500 million customers in 17 countries across south Asia and Africa. When several companies succumbed under the stiff pressure of unhealthy competition from Reliance Jio, Airtel fought vigorously with tremendous determination and remained unbowed. Today, Airtel is India's largest integrated communications solutions provider and the second largest mobile operator. Its retail portfolio includes high speed 4G/5G mobile broadband, Airtel Xstream fibre that promises speeds upto 1GBPS, with conversion across linear and on-demand entertainment streaming services spanning music and video digital payments and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cyber security, Internet of Things, Adtech and cloud-based communication.

Despite unhealthy competition from Reliance Jio, Airtel has gone from strength to strength on the financial front. During the last 12 years, its sales turnover has expanded from Rs 76,947 crore in fiscal 2013 to Rs 149,982 crore in fiscal 2024, with operating profit shooting up over three and a half times from Rs 22,960 crore to Rs 78,292 crore and net profit inching up almost four times from Rs 2,267 crore to Rs 8,558 crore.

Currently, Airtel boasts the highest ARPU at Rs 209 in the market, followed by Jio at Rs 181.7 and Vodafone Idea at Rs 146, as of March 31, 2024. After the price hike, Airtel's number one position will remain intact at Rs 280 by 2026 and Rs 300 by 2027. The management believes that the price rise will enable the company to go for substantial investments required in network technology and spectrum, and also offer a modest return on capital. Shares of the company are quoted around Rs 1,430 (face value Rs 05). Analysts expect the price to go up steadily to Rs 2000 in the medium- to long term.

Interestingly, the biggest beneficiary of the price hike is the financially crippled and smallest telecom company among the three players - Vodafone Idea -- as it is a pureplay mobile operator.

With the help of the government which has taken a sizeable stake in the equity capital of the company, thus converting its dues into equity, Vodafone Idea will now be on a stabilizing path. The share price of the company, with a face value of Rs 10, has improved from the low level of Rs 7 to Rs 16.

Thanks to the price hike, all three telecom players will be heading for a re-rating due to a unique combination of factors. With just three major players -- Reliance Jio, Bharti Airtel and Vodafone Idea -- controlling the market, even a minor rerating in ARPU can significantly impact their stock prices. Discerning investors can certainly go for Airtel, Jio and VI in that order without any hesitation.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives