Fortune Scrip

Published: June 15, 2024

Updated: June 15, 2024

Data Patterns (India) Ltd

Hi-flyer in defence, boosting 'Atmanirbhar Bharat' in aerospace

This fortnight we have selected Data Patterns (India), the brainchild of Srinivasagopalan Rangarajan,

which has during its existence of around four decades emerged as a leading player in the fields of

defence and aerospace. The Chennai-headquartered company specialises in designing and solutions. With a focus on indigenous development in line with the government's 'Make in India' policy

stance, the company offers a range of products that cater to the entire spectrum of defence and

aerospace (land, sea, air and space) platforms. It has a 100 per cent in-house development and

manufacturing capacity with a diversified order book and marquee customers. It has supplied

products for LCA-Tejas, the light utility helicopter and the Brahmos missile.

Today, the company stands out in the defence and aerospace electronics segment with a wide

range of diversified products. Its product portfolio includes: (1) radar, including surveillance radar

(which detects moving targets), weather radar (specialized for cloud and rainfall measurement),

wind profile radar (which helps in determining the direction and intensity of the wind at various altitudes), tracking radar (used by satellites to monitor the flight trajectory), and Brahmos missile

seeker; (2) electronic warfare (EW), including systems for electronic support; (3) avionics display

(used in cockpits of aircraft and helicopters); (4) automated test equipment (used in electronic devices for functionality and performance).

The diversity of the company's product range shows its ability to cater to a wide spectrum of

requirements in the defence and aerospace sectors.

The company has three diverse revenue streams: (1) Service (providing support and maintenance services) for electronic systems and sub-systems; (2) Development (design and development

of phase of a new product or customizing an already existing product to specific client needs; (3)

Production (actual manufacturing and sale of the company's products).

HIGH PROSPECTS

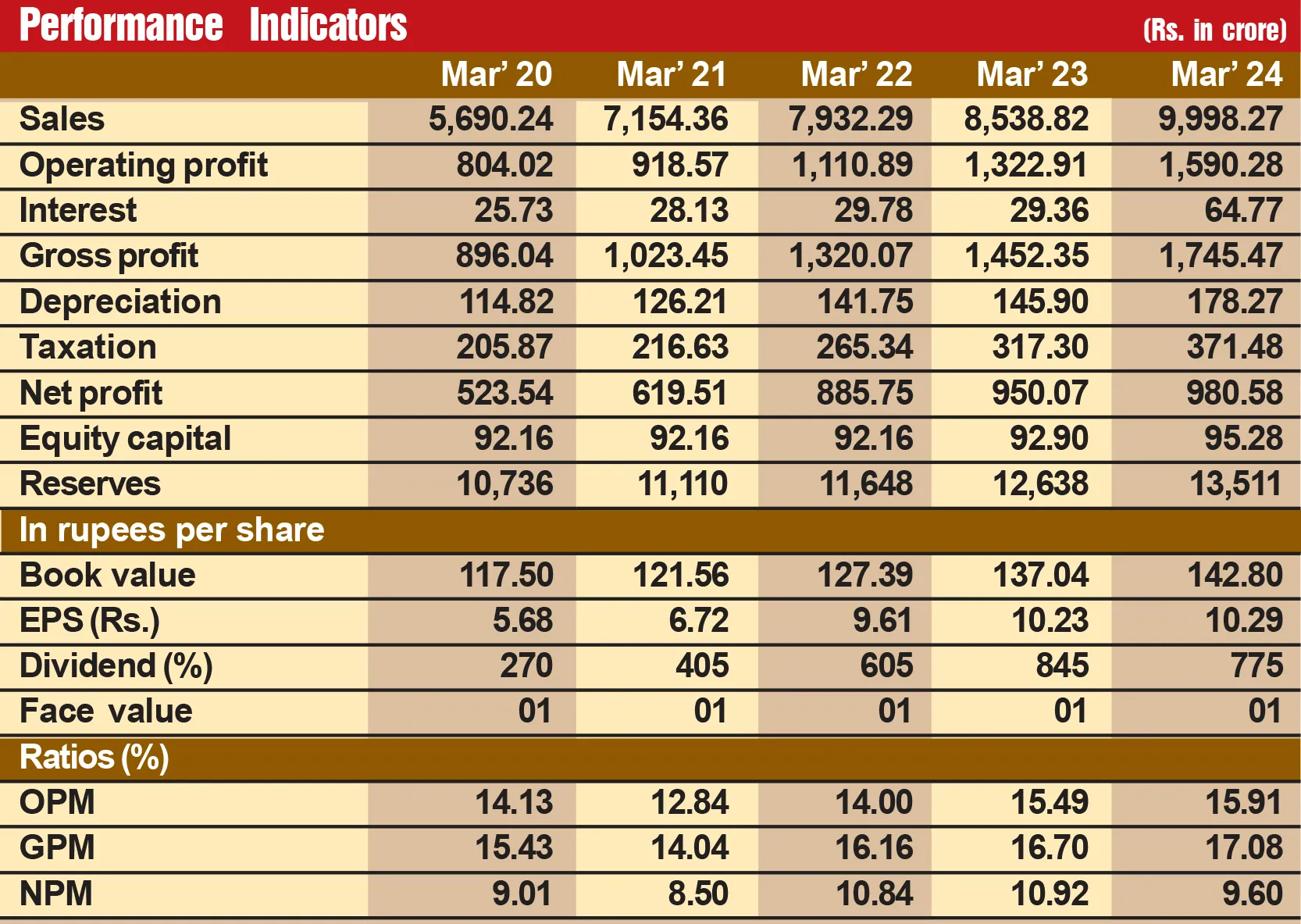

Demand for the company's products is on the rise and as a result its financial performance is

steadily improving. During the last 11 years, its sales turnover has expanded by over eight times from

Rs 63 crore in fiscal 2014 to Rs 520 crore in fiscal 2024, with operating profit shooting up over 13

times from Rs 17 crore to Rs 222 crore and the profit at net level taking a 26-time high jump - from

Rs 7 crore to Rs 182 crore. What is more, visible trends indicate that prospects for the company are

all the more promising going ahead. Consider:

-

Defence and aerospace have of late emerged as sunrise sectors in the Indian economy.

The government is pushing the 'Atmanirbhar Bharat' and 'Make in India' policies to make the

country self-sufficient in various products and substantially reduce imports. Today, India has the

second largest armed forces in the world; that translates to a lot of boots on the ground and the

need to provide them with quality technology and equipment. India's requirements for defence

are so huge that the country has emerged as the top importer of defence equipment in the world

during the last few years. Realising this, the government has concentrated on developing the

domestic defence industry. During fiscal 2024, the defence budget went up by 13 per cent to Rs

5.9 lakh crore and the same trend continued in the interim budget for fiscal 2025 with defence

allocation reaching Rs 6.2 lakh crore.

-

As India aims to become a major player in the global defence and aerospace market,

targeting a turnover of Rs. 1.75 lakh crore within a couple of years, including Rs 35,000 crore in

exports, the outlook for this sector is extremely rosy going ahead. An erstwhile top importer of

defence equipment, India is now striving to emerge as a key exporter. Last year, the country achieved

defence exports worth Rs 16,000 crore, and Rs. 20,000 crore in 2024. India has set a goal to achieve

over 70 per cent self-sufficiency in weaponry by 2027. Data Patterns is bound to be one of the

leading beneficiaries of these developments.

- After the change in the government's policies on the defence sector, Data Patterns started

getting big orders from DRDO, Bharat Electronics, Department of Space, etc. By March 2023, the

company's order book almost doubled to Rs 924 crore, and reached Rs 1,500 crore by March 2024.

What is more, according to the company's managing director, the anticipated order pipeline of Rs.

2,500-3,000 crore in the next 3-4 years provides strong revenue visibility.

- In fact, defence electronics provides a huge opportunity of Rs 1.5 lakh crore in the next 4-5 years, led by the armed forces' requirements of advanced systems (radar, EV communications and

satellites).

Rs 500-CR BOOST

- By now, the company has achieved remarkable competence in manufacturing radars, electronic warfare, avionics, fire control systems, check-out systems for Brahmos, etc. Now, after the

successful completion of a Rs 500- crore QIP, the company will focus on new product development

for the domestic and international markets.

- According to JM Financial, a leading brokerage house, the company has buoyant repeat

order prospects in the coming years in its targeted areas. The brokerage expects revenue/EPS CAGR

of 32 per cent/35 per cent over fiscal 2023/ FY2025 with improved cash conversion and return

ratios. The recent capital raising through QIP has strengthened the balance sheet and gives it the

financial muscle to invest in emerging technologies and platforms.

- The management is highly optimistic about the outlook of the company. Says Mr

Rangarajan, "I am confident we will continue to grow PAT at 30 per cent for the next seven years.

We are in an investment phase and continue investing in people, technology and infrastructure.

For fiscal 2024, EBITDA margin will be around 40 per cent." Pointing out that India is traditionally

used to importing major parts for defence purposes, Mr Rangarajan adds, "Delta Patterns will try to

build those products which are being imported. These can be ordered in India and we do that with

Indian technology. Hence, EBITDA, gross margins and the bottomline that we are looking at will

get maintained."

- Data Patterns can boast of +modern certified manufacturing facility of international

standards: Its in-house design and development capabilities are complemented by its 1,00,000

square feet manufacturing facility located on 5.75 acres of land at the SIPCOT Information

Technology Park, Siruseri, Chennai, which has facilities for design, manufacturing, qualification

and life cycle support of high reliability electronic systems used in defense and aerospace applications. The company's facility allows them to be self-sufficient in its requirement of high quality

and high complexity production while ensuring functional testing for all its products using

internally developed automatic testing equipment. The company is certified for or follows various standards across product life cycles, including for aerospace systems under AS9100D by

TUV-SUD, IPC Standards for PCB design, DO 178B for software for airborne systems, software

life cycle processes, etc.

- Shares of Data Patterns are in focus on Tuesday after global brokerage Jefferies assigned a

buy call to the multibagger stock post Q4 earnings. The brokerage raised its target price to Rs 4,135,

mentioning that earnings before interest, taxes, depreciation, and amortization (EBITDA) in the

fourth quarter were broadly in-line as higher margins offset lower revenue growth. It has a strong

revenue growth outlook of 25% for 2-3 years, with margins being maintained at around 40% (FY24

42.6% against 37.9% YoY).

- The company came out with an IPO in 2021, with an issue price of Rs 585, and got listed

on December 24, 2021 at Rs 864 (BSE). This shot up to Rs 2,484 in 2023 before shooting up to Rs.

2984 las week

- In terms of technicals, the relative strength index (RSI) of Data Patterns stock stands at

68.6, signaling the stock is trading neither in the oversold nor in the overbought zone. Data

Patterns shares stand higher than the 5 day, 20 day, 50 day, 100 day and 200 day moving

averages. The defence stock has a one-year beta of 0.8, indicating low volatility during the

period.

Discerning investors will do well to accumulate these stocks at every decline, as the stock is

fundamentally very strong and its future prospects are highly promising.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access