Fortune Scrip

Published: March 15, 2023

Updated: March 15, 2023

De Nora India

Post-hiccups, back to growth path

This fortnight, we have selected a unique small cap multinational company (equity capital Rs

5 crore, market capitalisation Rs 860 crore). This little-known company is De Nora India, a

subsidiary of the De Nora group of The Netherlands. In fact, the parent company was founded

by Italian engineer Oronzio De Nora in 1923. Subsequently, the company promoted subsidiaries

and joint ventures throughout the world. Today, there are 25 operating companies in 10

countries. Five R&D centres in Italy, the US and Japan ensure continuous improvement and

enlargements of its proprietary technology covered by about 260 patent families with over

2,700 territorial extensions. The company’s subsidiaries are in Italy, Germany, The Netherlands,

Europe, the US, Canada, Japan, Singapore and China, and De Nora serves customers in

more than 100 countries.

In 1988, De Nora decided to enter India and joined hands with an Indian promoter group

headed by the then Managing Director of Alfa Lavel. The next year, in late 1989, it formed a company

styled Titanor Components Ltd, which acquired the metal anode division of Wimco located in

Parwana village, Rampur (UP). As the volume of business started growing, the company set up a

state-of-the-art plant in Kundaim, Goa and started meeting the demands of the rapidly developing

chlor-alkali industry. Subsequently, the name of the company was changed to De Nora India. Its

strength lies in its technical expertise backed by well-trained specialists who are supported by the

parent’s highly qualified engineering staff.

SOME MIS-STEPS

The company began on a highly promising note but in the first decade of the new millennium

started faltering as promoter Devika Khanna’s ‘arbitrary’ actions dismayed the parent company,

which refused to supply technology and other support. As a result, the company’s performance

started deteriorating. The sales turnover dropped to Rs 30-40 crore, and operating profit, which

dropped to Rs 7 crore in fiscal 2011, nosedived further to zero in 2019.

The company’s future seemed bleak, but fortunately for it the Indian promoter was declassified

as promoter. There was no go but to sell the shares of De Nora India at a price of Rs 250 in the market,

and thus the parent company with a 54 per cent equity stake took full control of the management.

Technological and other support were restored and the company returned to the growth path.

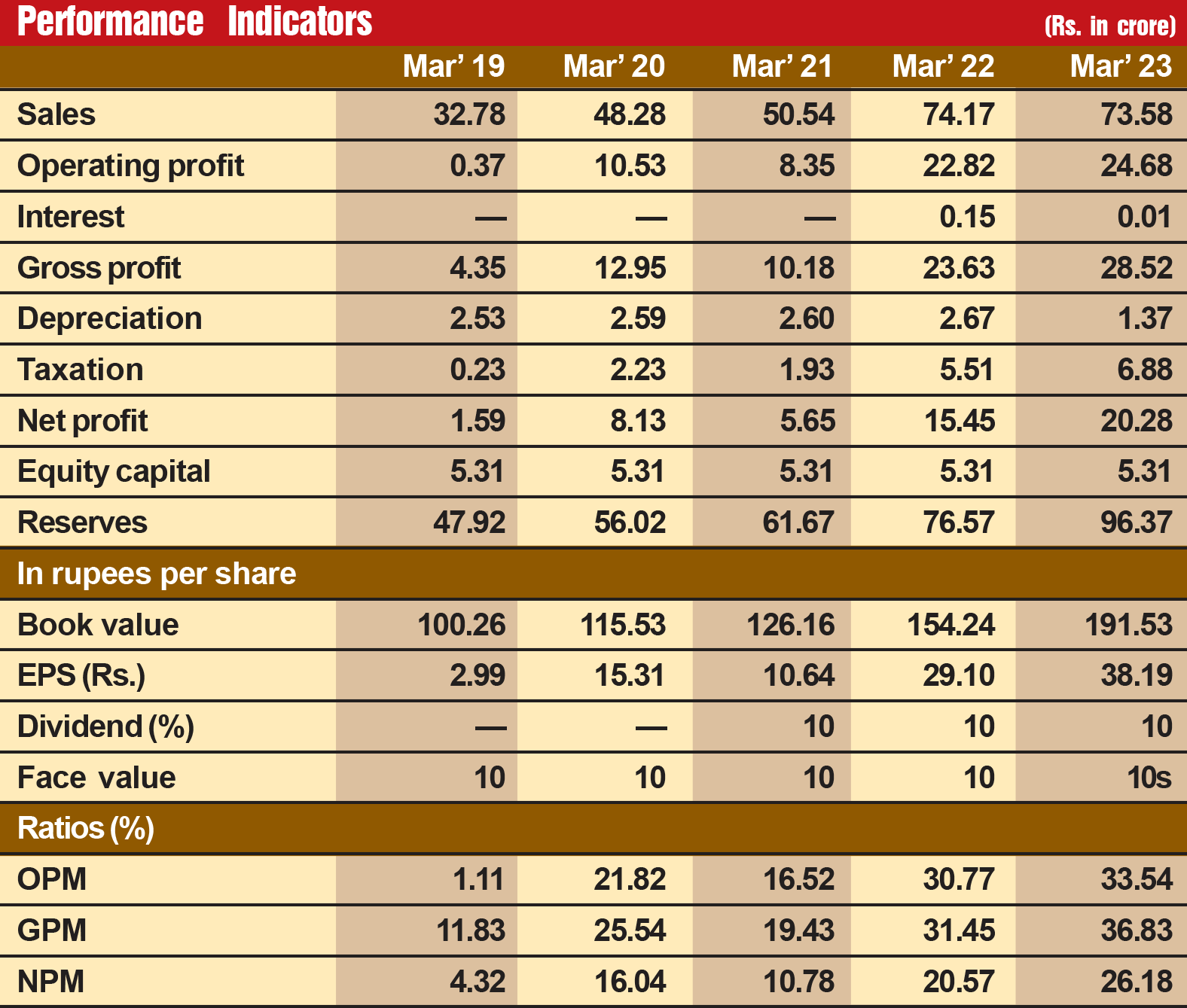

During the last five years, its sales turnover has more than doubled from Rs 33 crore in fiscal 2019

to Rs 74 crore in fiscal 2023, with operating profit shooting up from zero to Rs 25 crore and the profit

at net level surging from Rs 2 crore to Rs 15 crore.

TECH FLOW

The Indian subsidiary was not only ensured a regular flow of technology but was also now able

to seamlessly import knocked down kits, components and spares on credit from De Nora subsidiaries

worldwide. As the company started doing well, its share price started jumping up to reach an alltime

high of Rs 2,334 before settling at around Rs 1,630.

We have picked De Nora for our Fortune Scrip status this fortnight as the worst is over for the

company after Devika Khanna of the Indian promoter group left the company. Now, the company is

on a steady growth path. What is more, with green hydrogen getting a lot of importance in the

country's energy policy, prospects for De Nora have brightened all the more. Consider:

-

The company operates in three divisions: (a) electrode technologies, (b) water technologies, and

(c) anti-corrosion systems. As far as the electrode technologies division is concerned, De Nora has

electrodes repair and electrode manufacturing in the same plant for synergy. But in India a major

requirement is for recoating, while manufacturing electrodes is limited to the chlor-alkali industry.

Manufacturing these in the USA plant is very expensive. Hence, the Indian company is exporting its

electrodes for the chlor-alkali industry to the US and elsewhere. This business is expected to grow further, going ahead. At the same time, De Nora outside India manufactures electrodes for all

applications, including those used in fuel cells for industrial and electrical vehicles, in a joint venture

with AFC Energy Plc. India will also take up manufacturing of these electrodes for all applications.

But at present the Indian company has only one plant in Goa, which is not enough. However, the

company has a sizeable land bank in Goa for future expansion. De Nora India will set up another

plant to take up this manufacturing, which has very bright export prospects.

WATER TECH

-

In the second business (water technologies), De Nora India manufactures standard as well as

client specifications. The company manufactures all types of electro chlorinators for water purification

for drinking water in railways, townships, residential flats, hotels, industries, swimming

pools, water theme parks, etc. The company has tremendous growth potential in this segment.

-

Just after the parent company took control of De Nora India from the Indian promoters, the

company bagged a tender for industrial electro chlorinators from BHEL, Tamil Nadu for Rs 12

crore. Electro chlorinators are a must in coal, power, steel, nuclear, oil & gas and other industries

that use sea water. The company has very good business prospects in this division.

-

Till now, these chlorinators -- their kits, components, spares etc. -- are being imported from China

and Singapore. Thanks to the government's policy of 'Make in India', De Nora India will emerge

as a major beneficiary in this division.

-

Anti-corrosion systems are used in steel, construction, marine, ships, industrial projects, etc., for

prolonging life and durability. There is immense growth potential for this division as anti-corrosion

coating is used in oil & gas pipelines for prolonging their life, as also for railway tracks,

structures, bridges, etc.

With the parent company taking full control, the company is bound to grow very fast in all these

three activities.

GIANT'S ENTRY

-

In 2021, Snam SPA - one of the world's largest energy infrastructure operators and one of Italy's largest

listed companies -- acquired the entire stake in De Nora from Blackstone, thus becoming an industrial

partner to De Nora and leveraging its portfolio of solutions for the production of green hydrogen. As

per the new energy policy of India, green hydrogen is going to play a substantial role in achieving the

Indian government's goals of energy independence by 2047 and net-zero by 2070.

Green hydrogen is produced by the process of electrolysis where water is split into hydrogen and

oxygen, using electricity generated from renewable sources like solar, wind and hydro power. This

process results in a clean and emission-free fuel that has a huge potential to replace fossil fuel.

Viewed from serveral angles, the importance of hydrogen in achieving energy independence for

India cannot be overstated. Little wonder then that India has launched the National Green Hydrogen

Mission with an outlay of Rs 19,744 crore. De Nora can play a very significant role in the green

hydrogen push, which will also give a big push to the topline and bottomline of the company.

-

The company's shareholding pattern is very healthy, as around three-fourths of all its shares are

held in strong hands - 54 per cent in the hands of the Italian promoters and over 20 per cent in

HNI and NRI investor groups. In the last quarter of the last year (March 2023), ace investor Mukul

Agarwal bought 72,785 shares (a 1.37 per cent stake) as he has realized the great growth

potential of the company.

Realising that the fortunes of the company have undergone a dramatic change with the ouster of

the Indian promoter, investors have rushed to buy these shares. At a result, the share price has

zoomed to Rs 2,334 before settling at around Rs 1,750. Discerning investors should include this

multibagger stock in their portfolio.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access