Fortune Scrip

Published: March 31, 2024

Updated: March 31, 2024

KEI Industries

Pan-India presence in wires, cables

This fortnight we have selected a prominent wire and cables company as the Fortune Scrip.

Incorporated way back in 1968, New Delhi-headquartered Krishna Electric Industries, which began

life as a small partnership firm, has during the last five decades blossomed into a global empire

(listed as KEI Industries on the stock exchanges) that provides comprehensive wire and cable

solutions through a vast network of over 30,000+ channel partners. The company, which initiated

its journey in 1968 with a primary focus on the production of rubber cables for house wiring, can

boast today of a wide range of of over 400 products, including:

With these products and capabilities, the company serves a wide spectrum of sectors such as

power, oil refineries, railways, automobiles, cement, steel, fertilizers, textile and real estate.

KEI is much more than just a cables and wires producer. It is an industry and market leader in India

and a chosen supplier to both private and public sector clients worldwide. It is an end-to-end solutions

provider with a product line-up that includes every type of cable and wire created to meet the unique and

niche needs of its diverse clients in the retail, institutional (EHV+EPC) and exports segments.

The company has made investments in expanding its capabilities and constructing flexible

manufacturing facilities over the years, positioning itself to take advantage of opportunities arising

from power utility, core infrastructure, industrial and building and construction projects around the

nation. The prospective horizon is further broadened by its judicious entry into the EHV cable

segment and EPC services for power sector projects.

FINANCIAL SURGE

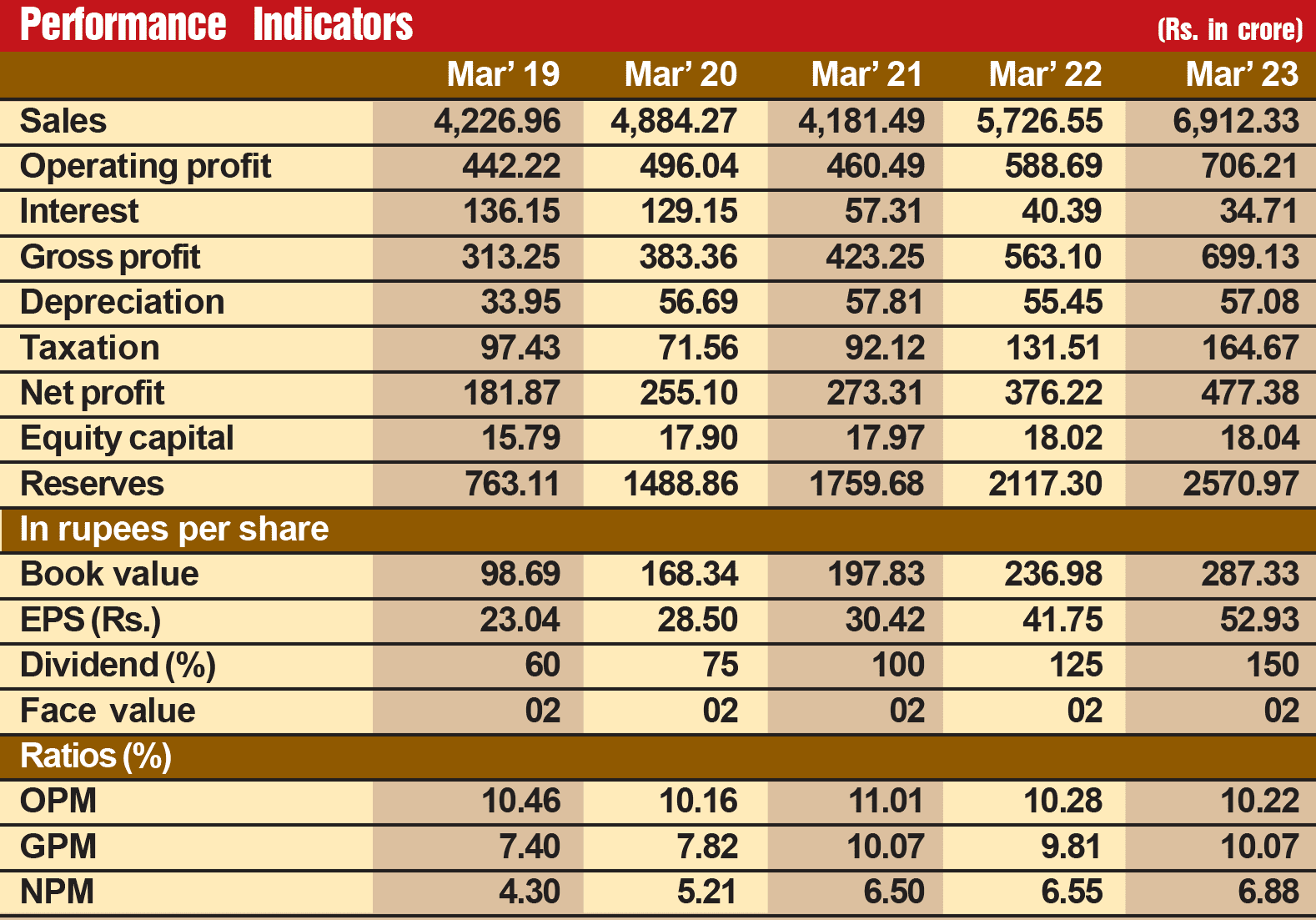

KEI has been steadily growing on the financial front. During the last 12 years, its sales turnover

has increased four-fold from Rs 1,706 crore in fiscal 2012 to Rs 6,912 crore in fiscal 2023, with

operating profit expanding more than four times from Rs 150 crore to Rs 706 crore and the profit at

net level surging over seven times from Rs 24 crore to Rs 177 crore.

However, we have not selected KEI as the Fortune Scrip on account of its past robust financial

performance. We strongly feel that prospects for the company going ahead are all the more promising.

Consider:

-

With a view to lifting India into the ranks of economically developed countries, the government

has been giving a strong thrust on infrastructural development, and the ever-increasing capital

allocation towards the sector in successive budgets will continue to boost the demand for wires and

cables. Further, government initiatives such as ‘Housing for All’ and higher allocation for affordable

housing under the Pradhan Mantri Awas Yojana could boost growth in the retail segment. KEI is

focused on strengthening the revenue contribution from the retail sector in the medium term through

strengthening its sales teams, widening its distribution network and improving brand visibility.

-

At the same time, the company is planning to invest in scaling up its LT, HT and EHV cables

capacity. The company has entered into a technical collaboration with Brugg AG of Switzerland for

the manufacture of EHV cables. It also has a presence in the EPC and turnkey solutions segment for

infrastructure projects. The company’s presence across diverse products and geographies enables it

to cater to a wide range of customers.

-

KEI has changed its marketing policy by focusing more on the retail segment which comprises

house wires, winding and flexible wires, LT power cables and HT cables. The products are

available pan-India through the company’s well-entrenched and expanding network of authorised

dealers and distributors. Today, the country’s northern and western regions account for 65 per cent

of its sales. Now, with the dealer expansion, it is planning to strengthen its sales in the eastern and

southern parts of the country. Since the company has identified the retail segment for driving its next

leg of growth, retail sales have been steadily growing at a CAGR of 20 per cent, driven by investments

in brand building and the distribution network. The company aims to scale up the retail contribution

to 50 per cent of overall sales in the medium term, led by 40 per cent growth in housing wires. It

remains focused on growing its dealer network, deepening engagement with channel partners and

strengthening the brand visibility through increased investment. Besides, it has hired a leading

consultant for the development of strategies and policies for giving a boost to sales through the retail

dealer network. The company has also devised a strategy to foray into the distribution network and

brand positioning. These plans are being evaluated to boost its retail sales.

BIG CLIENTS

-

Along with a thrust on the retail segment, KEI also plans to focus on institutional sales. This

segment comprises EHV cables, HT and LT power cables, stainless steel wires and EPC solutions. The company serves more than 1,450 institutional customers and holds around 12 per cent

marketshare. Its strong pre-qualification credentials are a key factor enabling it to cater to institutional

demand. Experts point out and the management also agrees that EHV cables will drive the growth of

institutional business of the company. Interestingly, KEI is one of the few Indian players having the capability to manufacture EHV cables

over 220 KV and is also amongst the select players globally to manufacture EHV 400 KV cables, thanks

to its technical tie-up with century-old Swiss company Brugg Cable AG. This collaboration enables KEI

to provide a high-end designs process, and back-up services benchmarked to the highest global

standards. This will prove to be a boon to the company in pushing up its institutional business.

-

Realsing the growth potential in export earnings, the company has started exploring newer

opportunities in export markets. At present, it is exporting its wide range of cables, including EHV

cables, HT cables and LT power cables, stainless steel wires, etc, to over 50 countries. In order to

drive customer outreach efforts and build global relationships, the company has set up overseas

marketing/project offices in Australia, Dubai, Nepal, Nigeria, Zambia and South Africa. Demand for

its products is on the rise and in order to tap the growing opportunities arising from the export

market, the company is now looking to build a new authorised dealer and distribution network in

international markets with a focus on both domestic and industrial cables and wires.

FOCUS ON U.S.

To begin with, the company plans to increase its export share, particularly in the US market,

following the recent approval of its products for export to the US by fiscal 2024. The company hopes

to significantly enhance its exports to the US in the coming years.

-

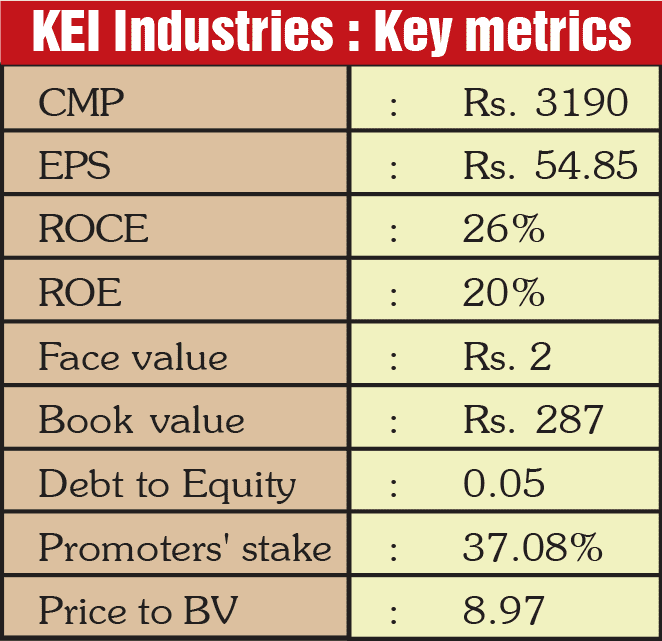

An analysis of the stockholding pattern suggests that a sizeable portion of the holding is in

strong hands, with institutional holding of 41 per cent and the promoters' holding being over 37 per

cent. Retail investors have a relatively small holding of over 21 per cent. The substantial institutional

holding suggests that the company is fundamentally strong and has better days ahead.

-

KEI's balance sheet is very strong. Its financial position is extremely sound, with reserves at

the end of March 2023 standing at Rs 2,751 crore - almost 143 times its equity capital of Rs 18 crore.

The company has been systematically reducing its debt, with borrowings coming down sharply from

Rs 842 crore in fiscal 2018 to Rs 1,162 crore in fiscal 2023, and the interest burden coming down

sharply from Rs 136 crore in fiscal 2019 to Rs 35 crore in fiscal 2023. The company's return ratios are

also quite impressive, with ROCE standing at 23 per cent and ROE around 20 per cent. The company's

credit worthiness is also very high. India Ratings and Research, ICRA and CARE have upgraded the

rating to AA from AA- for long-term bank lendings and all have affirmed an A-1 rating for short-term

bank facilities.

GUJARAT UNIT

-

With a view to ensuring a sustained pace of growth,

the company has chalked out an ambitious growth plan. It

has planned to invest Rs 1,000 crore over the next 3-4 years

for the establishment of an advanced manufacturing facility

in Gujarat.

The share price has more than doubled during the last

52 weeks from Rs 1,571 to Rs 3,472, before settling around

Rs 3,215. Even this price is not too high, viewed in the context

of its fundamental strength and the even rosier picture

going ahead. These shares are a must in the portfolios of

discerning investors with a long-term perspective.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access