Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2024

Updated: May 31, 2024

The 2024 general elections are done and dusted, leaving behind the political uncertainties that could have disturbed the business environment for India Inc. This fortnight, we have picked Tata Consumer Products, a recently reconstructed FMCG company of the illustrious House of Tatas. The company is not only fundamentally, financially and operationally strong, and efficiently managed, it also has tremendous growth potential and is on course to emerge as an Indian FMCG giant.

Consider how ths new FMCG entity has taken shape. First, Tata Global Beverages (formerly known as Tata Finley and subsequently as Tata Tea), saw the consumer products business of Tata Chemicals merged with it. Then followed an acquisition drive. The group took over Bengalurubased Kottaram Agro Foods (owner of the cereal brand ‘Soulfull’, the bottled water business of NourishCo and Tata Smart Foods. Going a step further, TCPL acquired BigBasket, a well-established distribution outfit, and renamed it Tata New.

The architect of the reconstructed entity, Tata group chairman N. Chandrasekaran, Chairman of the Tata group, avers, “We will continue to look for right acquisition opportunities in different categories with a view to leveraging its product portfolio, expanding distribution network and product innovation, as well as entering new categories. We are on a mission to create a premier and pacesetting diversified consumer products company. Our strength is in our deep understanding of our consumers in India and in international markets with our iconic market-leading brands and wide consumer reach. We are committed to delivering high-quality, innovative, tasteful and convenient products with goodness at its core.”

He continues, “Our portfolio of products ranges from tea, coffee, water and ready-to-drink to salt, pulses, spices, ready-to-eat and more. In the beverages business, Tata Consumer Products is the second largest player in branded tea in the world. Our brands include Tata Tea, Tetley, Vitax, Eight O’ Clock Coffee, Himalayan Natural Mineral Water, Tata Coffee Grand and Vitax.

“Beginning with the iconic Tata Salt that pioneered the crusade for iodisation in India, our food business is one of the most trusted food brands in India and we have extended our portfolio to include salt variants for different markets and nourishing food products. With Tata Sampann, we bring the traditional wisdom of Indian food in a contemporary package to deliver the best of taste, nutrition and convenience.

“Tata Soulfull, the brand owned by our subsidiary Tata Consumer Soulfull, was launched in 2013. The brand operates in the Health & Wellness focused food segment with a portfolio of milletbased cereals and snacks for children and adults. With a combined reach of over 201 million households in India, the company has an unparalleled ability to leverage the Tata brand in consumer products.”

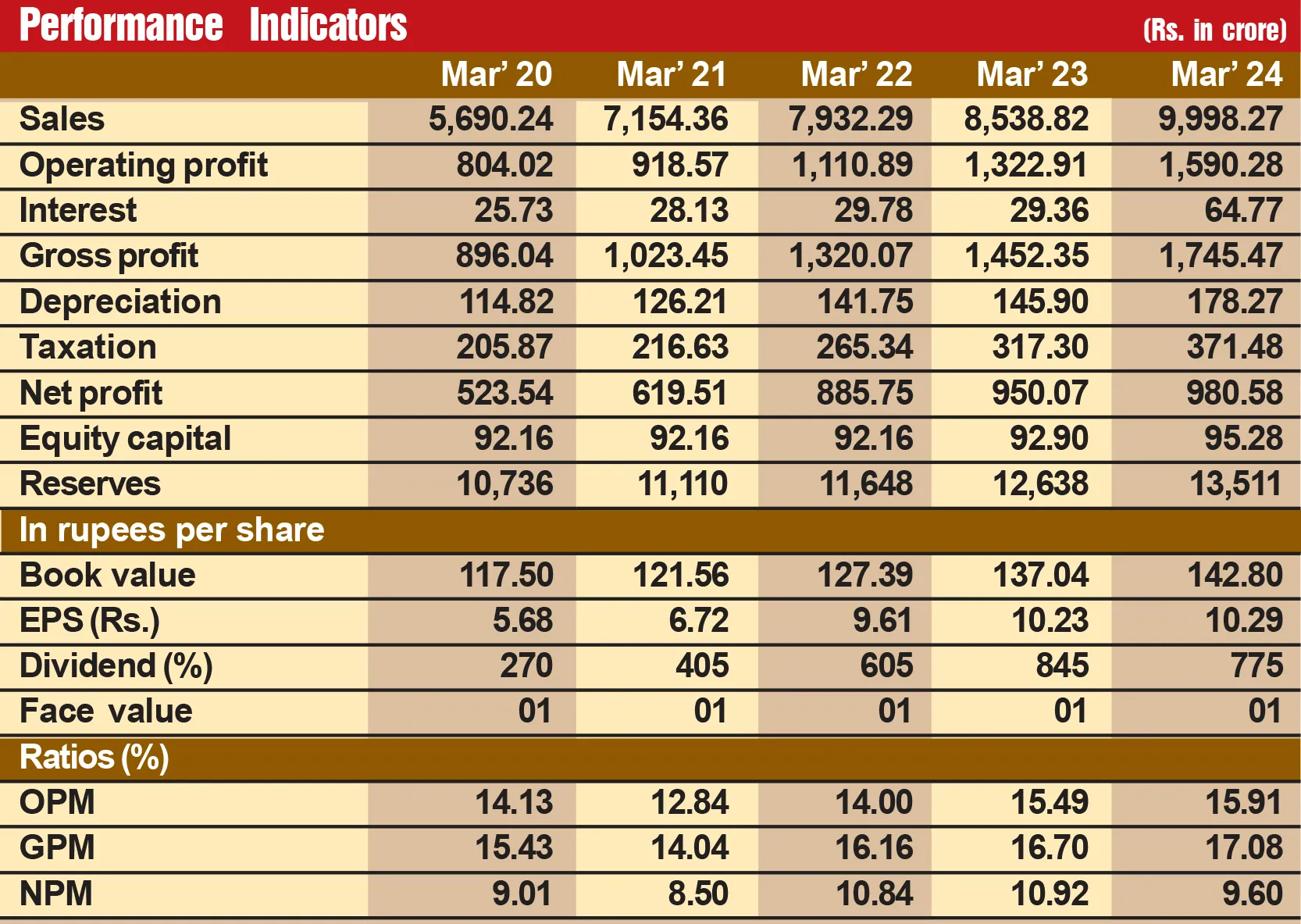

The company has gone from strength to strength on the financial front. During the last 12 years, its sales turnover has more than doubled from Rs 7,351 crore in fiscal 2013 to Rs 15,206 crore in fiscal 2024, with operating profit trebling from Rs 770 crore to Rs 2,284 crore and net profit also trebling from Rs 445 crore to Rs 1,215 crore.

However, we have not picked TCPL as the Fortune Scrip for its past laurels; we strongly feel its future prospects are all the more promising. Consider:

TCPL products are highly popular not only in India but even globally. Its products have strengthened its presence in the key focus markets of the UK, the US and Canada. Tetley, Good Earth and Teapigs are its core tea brands in these markets. The company has also launched new products in its Eight O’Clock coffee portfolio and RTD portfolio with Teapigs Kombucha, Teapigs Cold Brew and Good Energy (a natural energy drink).

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives