Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2024

Updated: May 31, 2024

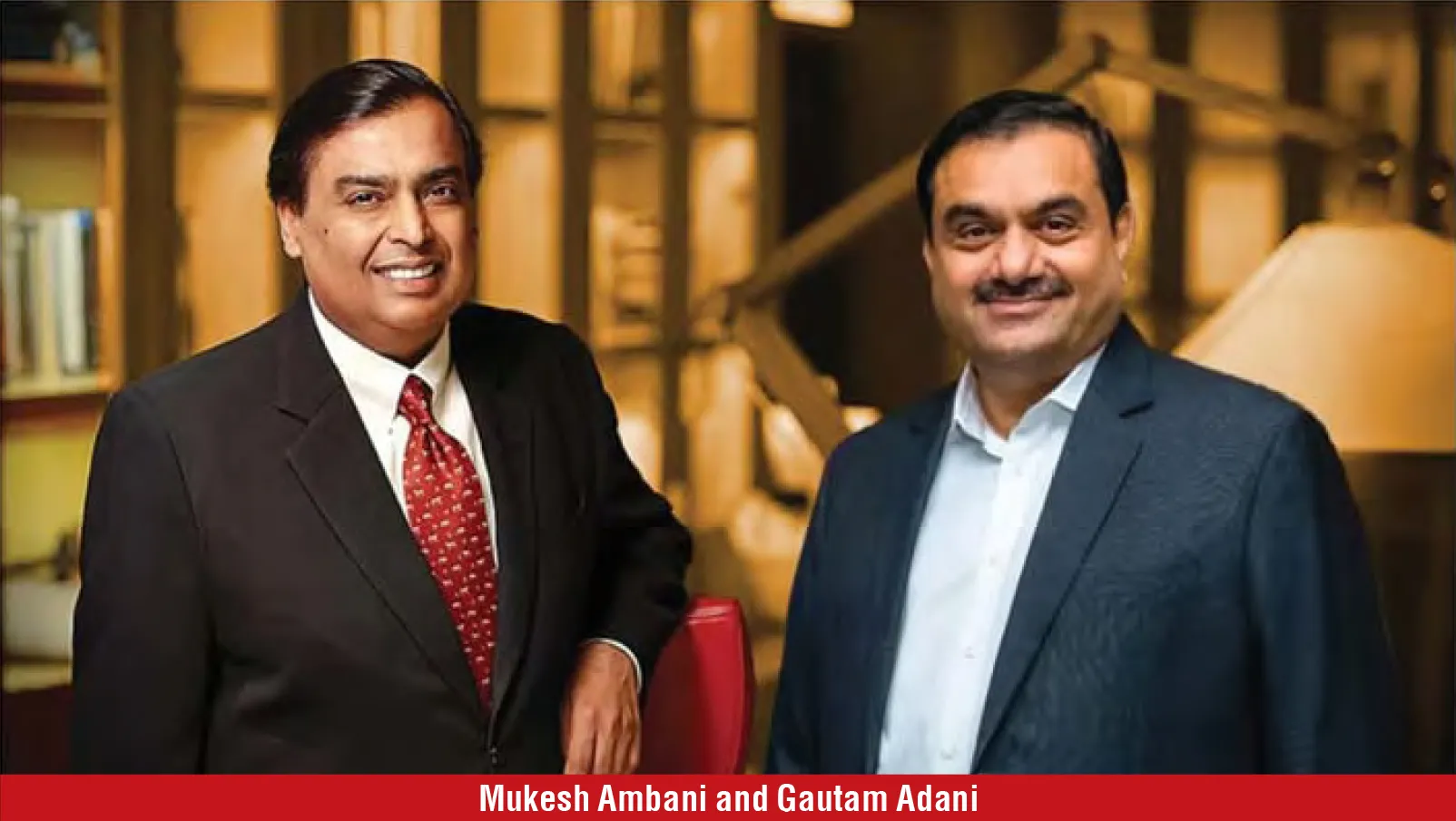

With the NDA’s performance significantly weaker than in the 2019 elections, analysts are debating whether to bet on Ambani and Adani stocks. Though analysts say the government’s economic agenda may not change much, the Modi-3 government is expected to continue with its investment-led economic agenda, but may tweak its priorities to support consumption and employment.

Adani and Ambani companies which are creating new jobs and hence need to be supported by the new government — irrespective of its composition.

Analysts say the government may continue with its focus on affordable healthcare and housing, energy transition, infrastructure development and manufacturing. The government has already executed the bulk of the required reforms for incentivizing private investments and this will benefit Ambani and Adani companies.

Analysts from Kotak expect a reset in the market’s hitherto cavalier investment stance towards ‘narrative’ stocks. Analysts have struggled with the implied growth and profitability assumptions embedded in the market capitalisation of several ‘narrative’ stocks (capital goods, electric utilities and PSUs). These analysts find the risk-reward climate unfavourable for these companies, notwithstanding the sharp decline in stock prices on election day. Most of these ‘narrative’ stocks have risen sharply over the past 12-15 months, offer a large downside to their fundamental fair values, and trade at rich-to-bubble valuations.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives