Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2024

Updated: May 31, 2024

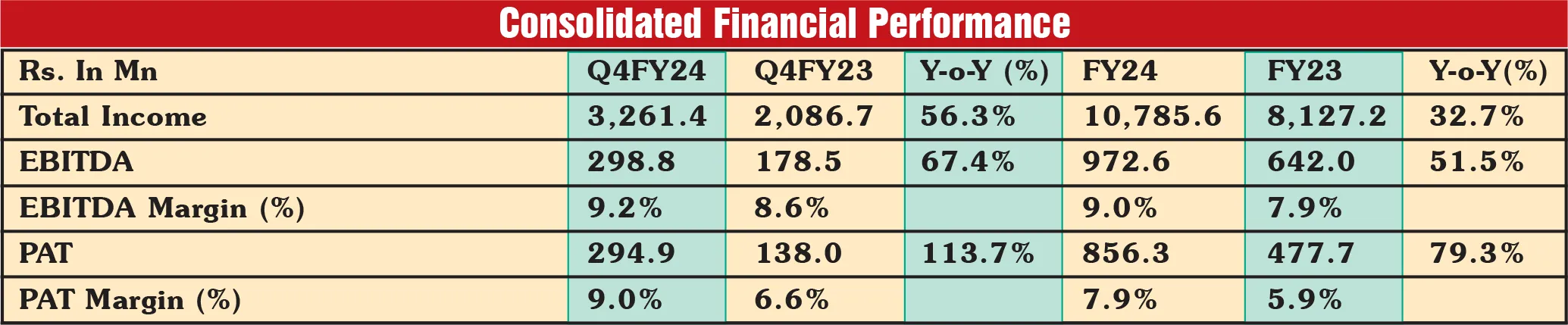

Paramount Communications Ltd., established in 1955, a leading player in India’s wire and cable industry, has announced its earnings for the quarter and year ended 31 March 2024.,

The company recorded a Robust order book of Rs. 4,951.6 Mn, coupled with Strong performance across product range, especially led by strong growth in power and railway cables. Exports continue to remain healthy as the company achieve similar volumes as compared to FY23. Increasing production driving economies of scale and profitability. Healthy balance sheet with debt equity ratio of 0.16 and current ratio of 3.40.

The company is poised to become debt free during FY25 after full repayment of ARC debt of Rs. 862.5 Mn. Revenue from domestic operations in FY24 amounted to Rs. 7,944.8 Mn, showing a 100.5% Y-o-Y increase from Rs.3,961.8 Mn in FY23. In terms of sales mix, domestic sales stood at 74.2% and exports stood at 25.8%

Commenting on the results Mr. Sanjay Agarwal, Chairman & CEO said, “FY24 has been a remarkable year for Paramount Communications. We have achieved strongest ever performance in terms of revenue and profitability. This year, we reached a significant milestone by surpassing Rs.1,000 crore-mark in revenue showing a growth of 34.4% y-o-y. This achievement is underpinned by strong demand for our product portfolio and not only highlights the strength of our client relationships but also reaffirms our consistent delivery on commitments.

Our order book which currently stands at Rs. 4,951.6 Mn, provides strong visibility of revenues. Paramount is optimistic about further expanding its order book, bolstered by significant support from the railway and power sectors.”

He adds, “our focus on operational excellence has led to significant improvements in our financial performance. In FY24, our EBITDA has increased to Rs. 972.6 Mn, showcasing a 51.5% growth as compared to Rs.642.0 Mn in FY23. This growth, coupled with an EBITDA margin of 9.0%, reflects the benefits of operating leverage and a sharp focus on cost control.

In FY24, Paramount achieved a significant milestone by substantially repaying its ARC debt and positioning itself to become debt-free by FY25, demonstrating its commitment to prudent financial management. This achievement strengthens the company’s balance sheet and ensures sufficient capital to pursue growth and enhance capabilit

Strategically positioned, Paramount is poised for strong and sustained growth, with a focus on diversifying our product range and delivering top-notch quality solutions in the wires and cables sector, while continuously innovating new products. We are prepared to leverage the anticipated increase in orders and position ourselves adeptly for potential opportunities. With these positive advancements, we remain confident in our capability to consistently deliver strong results for all our stakeholders in the times ahead.”

Incorporated in the year 1955, Paramount Communications Limited is a prominent player in the India’s wire and cable industry, renowned for manufacturing high-quality products catering to diverse infrastructure segments. The company operates through 2 state-of-the-art manufacturing facilities situated in Khushkhera, Rajasthan and Dharuhera, Haryana. These facilities hold certifications from various Indian and global agencies, testifying their strict compliance with high quality standards.

It boasts of an expansive product portfolio that comprises over 25 distinct products and an impressive array of over 2,500 SKUs. This diverse selection serves a wide spectrum of markets, including government, B2B, and B2C segments encompassing industries like power, railways, telecom, construction, defence & space research, and residential spaces. The company has an extensive pre-qualifications credentials and competencies has been instrumental in establishing its nationwide and international presence, notably in USA. Paramount holds the prestigious status of three star export house by the Government of India.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives