Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2024

Updated: May 31, 2024

THE freedom- and democracy-loving voters of India, in the form of ‘God’, have sent across a historic message to Prime Minister Narendra Modi by dashing his expectations of a humongous majority for both the BJP as well as the NDA in the just-concluded 2024 general elections.

EVEN as the exit poll ‘experts’ were wildly off the mark with their predictions of a BJP-NDA sweep, an emotion-driven stock market took its cue from the exit polls and went ballistic, only to fall rapidly after the June 4 results. It climbed back moderately once it became clear that Mr Modi would again lead the government – only this time, a coalition one.

WHILE market volatility may continue in the near term, experts offer a ‘mantra’ to navigate this phase: retail invesors should accumulate quality names in 3-4 tranches, maintain a diversified portfolio and avoid panic selling.

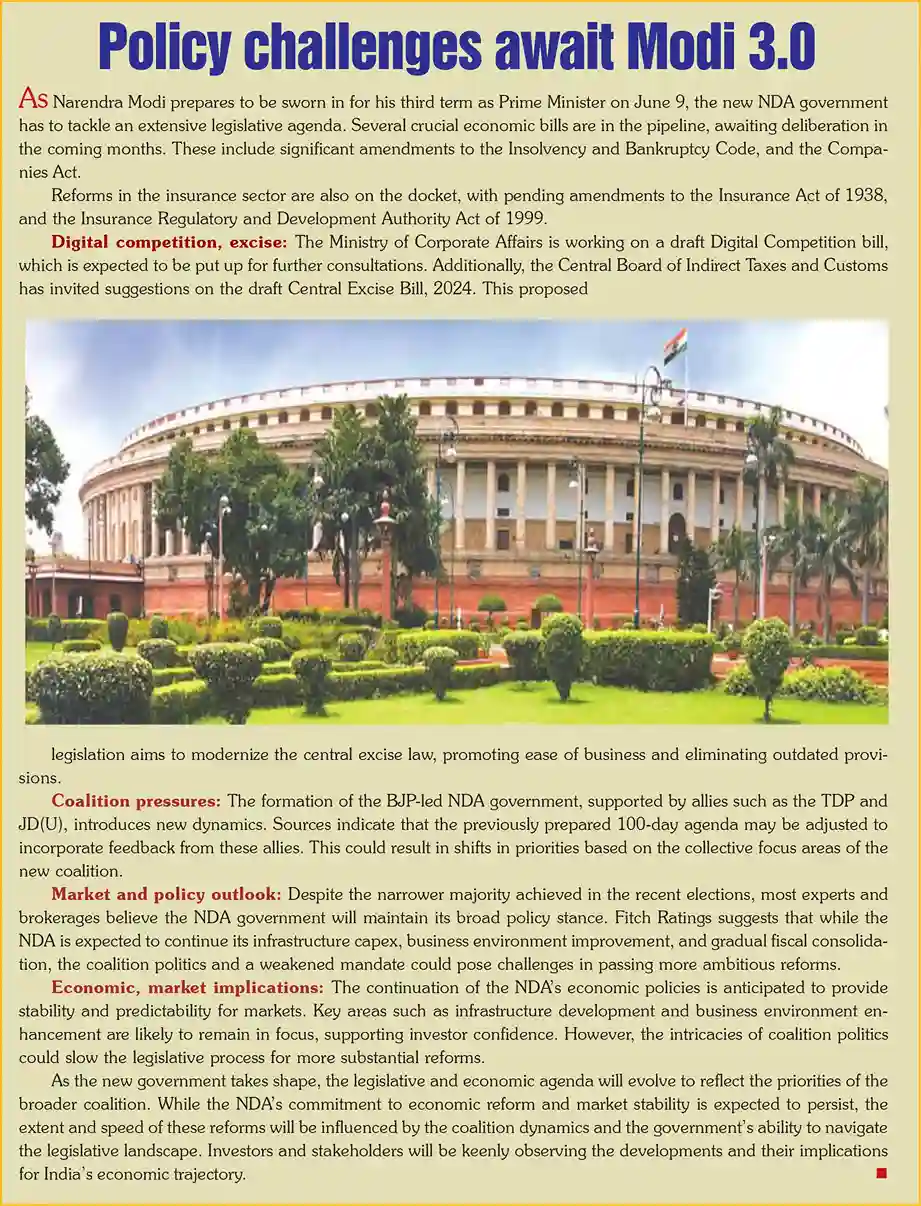

The god’ residing in New Delhi proposes, but the ‘god’ residing in the masses spread across the length and breadth of the country disposes! And so it has turned out in the recently-concluded Lok Sabha elections of 2024. Though Prime Minister Narendra Damodardas Modi had trumpeted nationwide about his party, the BJP, crossing the 400-seat mark in the 543-seat Lower House, the June 4 election results came as a brutal reality check for the BJP – the saffron party could garner ‘only’ 240 seats, a 60-plus seat fall from its mammoth performance in the last general elections of 2019.

Even as, on the strength of heading the single largest party, Mr Modi forms the new government, it will be a coalition one dependent on the support of unpredictable allies like Nitish Kumar of Bihar and Chandrababu Naidu of Andhra Pradesh.

Besides the seismic electoral shock to the BJP and its alliance partners in the NDA, the Indian stock market went southwards on a selling avalanche. Just a couple of days earlier, the markets had zoomed in a heady environment created by a number of ‘pro-Modi’ exit polls which had predicted that the BJP alone would win 350-370 seats this time and Mr Modi would form a third-term government.

With officialdom pushing the narrative of the ‘psephologists’ behind these exit polls, even market experts started taking them seriously. Dr VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, opined that the exit polls giving a clear majority to the NDA would completely remove the so-called election jitters which had been weighing on markets in May. This would come as a shot in the arm for the bulls. Large caps in financials, capital goods, automobiles and telecom were likely to lead the rally. Technically and fundamentally, the market was poised for a rally, he opined.

Chakrari Vardhan Kuppala, Executive Director, Prime Wealth Finserve, commented that with six exit polls predicting a clear victory for the Modi-led NDA, market sentiment was expected to get a significant boost. This wave of optimism could push the Nifty50 index up by 5-7 per cent in 4-6 months. “Historically, when political stability is assured we have seen a notable uptick in investment activity. After the 2014 elections, equity mutual fund inflows increased by about 15 per cent within six months as investors felt more confident about the economic outlook,” he opined.

Arpit Jain, Joint MD of Arihant Capital, maintained, “The market is expected to react positively to the upcoming budget, but there might be some profit-taking after the recent rally. Sectors like defence, railways and manufacturing will likely keep climbing and financials could also join the party. Divestment stocks might also perform well.”

According to Suman Banerjee, CIO, Hednova, market participants were likely to react strongly to indications from the exit polls of a clear majority for the BJP, potentially driving a rally in benchmark indices Sensex and Nifty 50. He added, “Conversely, a lower than expected seat count for BJP may result in increased market volatility and a short-term correction. Overall, the exit polls will significantly influence market sentiment and trading behaviour as investors adjust their positions in anticipation of the final election results on June 4.”

Pointed out Motilal Oswal of Motilal Oswal Financial Services, “The victory of the BJP will augur well for the economy and capital markets as it provides stability and continuity in policy-making. With a single-party majority government which will be expected to continue pushing its economic agenda with a clear verdict, markets will heave a sigh of relief and return to fundamentals/business-as-usual mode. In our view, fundamentally, India is witnessing its own mini-Goldilocks moment with excellent macros (GDP growth of 8.2 per cent, inflation at nearly 5 per cent, both current account and fiscal deficit well within the tolerance band, etc.).”

According to Kotak Institutional Equities, the exit polls suggested a comfortable majority for the BJP-led NDA, led by gains in east and south India and continued dominance in its traditional strongholds. “We expect the equity markets to be further energized by the polls and the government should continue its economic agenda,” it added.

Clearly, an exit poll-infatuated market reacted favourably, with the 30-stock BSE Sensex and the darling of analysts, Nifty50, based on 50 leading stocks, shooting up by around four per cent each. While the Sensex shot up from 73,961.31 points to a new all-time high of 76,768.78, Nifty50 rose from 22,530.10 to a new all-time high of 23,263.90 on June 3.

However, nobody reckoned that the ‘psephologists’ who prepared the exit polls did not really have their ear to the ground. Needless to say, the pro-NDA exit balloon burst the next day on June 4, when the completion of the vote counting made it abundantly clear that the BJP had fallen way short of the majority mark. Not only was the Prime Minister’s dream of 400+ seats for the NDA shattered, he now has to lead what could be a lame duck government dependent on support from Nitish Kumar and Chandrababu Naidu.

The moment it was known that not only had Mr Modi's balloon of 400+seats for the NDA and an absolute majority for his own BJP burst, the market tanked. A selling spree was set off when it was realized that the exit polls were bogus and their claims were delusional. The BSE Sensex tanked 2,800 points, the Nifty50 index was knocked down by over 1,000 points and the bank Nifty index crashed by over 2,800 points. Moreover, PSU stocks 'recommended' by Mr Modi were the worst sufferers.

Along similar lines, GIFT Nifty started trading at a discount of 1,438 points or 5.99 per cent at 22,061.00. The broader markets slumped in line with the Sensex and Nifty50. While the Nifty Mid-Cap 100 tanked by over 6,000 points, Nifty Small Cap 100 tumbled by 2,078.45. The Nifty PSE index nosedived 1,659.85 points, or around 15 per cent, to 9,677.75.

Besides PSUs, private group shares that faced a selling avalanche were those of the Adani group, a close associate of Mr Modi. Adani Power, Adani Green Power, Adani Ports and Special Economic Zones, Adani Enterprises, Adani Total Gas - all fell sharply on widespread distress selling.

But on June 5, the markets saw a ray of hope on the government formation front. Though Mr Modi was not able to form a government on his own with the BJP failing to reach the halfway 272-seat mark, let alone its own hopedfor 340 seats (significantly, well-known economist Parakala Prabhakar, husband of outgoing Finance Minister Nirmala Sitharaman, had predicted that the BJP would not be able to cross 340), the outgoing PM was propped up by NDA allies Nitish Kumar of Bihar and Chandrababu Naidu of Andhra Pradesh, and can (hopefully) keep his 'gaddi' for another 5 years with their support. With this development, the market stopped falling and started a slow recovery as the BSE Sensex improved to 74,382.24 and the Nifty50 to 22,620.35. The market sentiment was further bolstered by Mr Modi's confirmation as leader of the NDA in the Parliament and the announcement that he would be re-appointed as Prime Minister on June 8.

The Lok Sabha elections 2024 have thus had a twin fallout - the polls not only brought Mr Modi down to earth from his 'godlike' exalted position but also checked the runaway rise in the stock market and brought down prices to four-year low levels.

Till date, investors have been jubilant over Mr Modi's economic agenda, framed on the principles of 'Make in India' and 'Atma Nirbhar Bharat', with the aim of attracting foreign investment, promoting small and medium industry, and boosting infrastructural development so as to take India to the third position among the most developed countries globally. The last decade of Mr Modi's rule has seen a sustained upswing in the Indian stock market. Little wonder that earlier this year, India's stock market capitalisation topped $ 4.3 trillion to overtake Hong Kong as the world's fourth largest market.

During his election campaign, Mr Modi had repeatedly claimed a seat share of 400+ for the coalition and an absolute majority for the BJP, lulling investors into a sense of rosy complacency. But on poll D-Day, Mr Modi failed to come close to either of his two targets. Now, two of the legs of his prime ministerial chair will have to be propped up by allies in the form of Nitish Kumar and Chandrababu Naidu. He will have to keep them happy to retain his chair. Worse, any rift in the NDA alliance could lead to mid-term polls.

In view of such uncertainties, the market has seen its worst fall during the last four years. Alexander Hermann, senior economist at Oxford Economics, opines that Mr Modi's smaller-than-expected majority will make it more difficult to pass reforms related to land, labour and capital regulations. Furthermore, infrastructure investment will remain a key worry.

Ms Amisha Vora, Chairperson and MD of Prabhudas Lilladhar, maintains that the market is likely to shed its 'Modi premium' for a correction in PSU and infrastructure stocks. Once this turbulence stabilizes, attention will shift to core macro factors affecting India. Investors should brace for volatility in the short term but the underlying fundamentals of India's growth story remain strong, she opines.

Ajay Menon, MD and CEO (Broking and Distribution) at Motilal Oswal Financial Services, believes that the broader market may turn volatile as sentiments get hit. But the Indian equity market is expected to revive after the cool-down of volatility over the next couple of days. He says, "We expect the volatility around the outcome to reduce over the next few days and the market focus to return and continue to remain strong. Once the new government is formed, it will present its first and full budget for fiscal 2025, and themes like capex, manufacturing, rural, consumption and credit lending will be back in focus. Fural and consumption will also pick up pace with the onset and progress of the monsoon, which is predicted to be above normal this year."

While the market volatility may continue in the near term, Mr Menon suggests that retail investors should take this as an opportunity to accumulate quality names in 3-4 tranches. Over the next few days, the narrative around government formation and RBI monetary policy will take centre-stage, he notes

What should investors do in these circumstances? The history of the stock market reveals that despite initial periods of volatility, it tend to recover and even grow in the longer term. For instance, even after the 2014 and 2019 elections, the Indian stock market witnessed significant gains in the months following the election results.

Opines a knowledgeable market expert, "Investors are advised to focus on long-term strategies such as maintaining a diversified portfolio and avoiding panic selling. Strong fundamentals and resilience against political changes are crucial for navigating market volatility."

Pradeep Gupta, Vice-Chairman of the Anand Rathi group, says, "While the immediate market reaction to the election results has been volatile, the overall long-term outlook remains positive, particularly if policy continuity is maintained. Investors should stay well-informed, focus on fundamentals and be prepared for short-term fluctuation."

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives