Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 15, 2024

Updated: November 15, 2024

Nandan Denim Ltd. (BSE: 532641, NSE: NDL), a leader in the denim industry, has announced its earnings for the quarter and half year ended 30 September 2024.

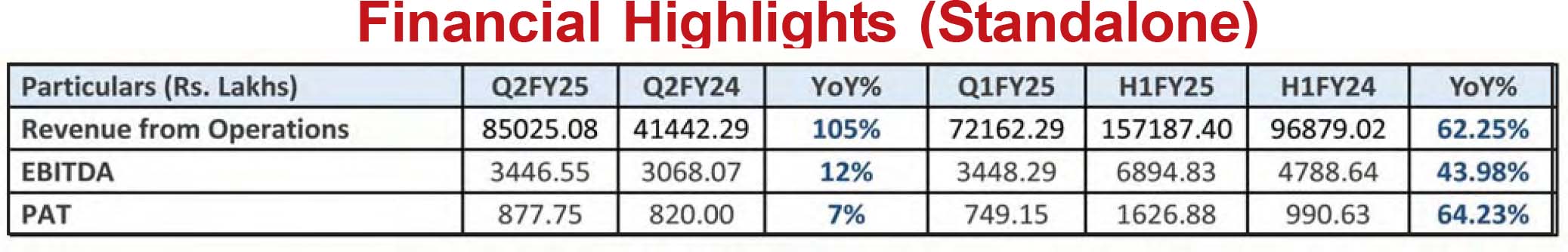

For the quarter ended 30 September 2024 (Standalone), the company the revenue from operations was reported at Rs. 82025.08 Lakhs, up 105% YoY. The EBITDA came in at Rs. 3446.55 Lakhs (Q2FY25), a growth of 12% YoY. PAT grew 7% YoY, from Rs. 820 Lakhs (Q2FY24), to Rs. 877.75 Lakhs (Q2FY25). For the half year ended 30 September 2024 (Standalone), the revenue from operations was reported at Rs. 157187.40 Lakhs, up 62.25% YoY. The EBITDA came in at Rs. 6894.83 Lakhs (H1FY25), a growth of 43.98% YoY. PAT grew 64.23% YoY, from Rs. 990.63 Lakhs (H1FY24), to Rs. 1626.88 Lakhs (H1FY25).

Earlier, the board approved and executed the Sub-division/split of Equity Shares of the Company in 1:10 ratio that is 1 share of Rs. 10 face value to 10 shares of Re.1 face value. For the year ended 31 March 2024, the company saw a 0.82% decline in its revenue from operations, declining marginally from Rs. 2026.76 Cr (FY23) to Rs. 2010.08 Cr (FY24). EBITDA grew 40.67% YoY, from Rs. 84.1 Cr (FY23), to Rs. 118.30 Cr (FY24). EBITDA margin recorded an improvement of 174 bps, and stood at 5.89%. PAT grew by a staggering 8384.91% YoY, from Rs. 0.53 Cr (FY23), to Rs. 44.97 Cr (FY24).

A global leading denim manufacturer, Nandan Denim Limited is redefining the denim industry for more than 27 years. With a passion for fashion and design, it produces more than 2000 denim products every year. The company manufactures and supplies denim fabric, yarn/dyed yarn, cotton fabric and shirting fabric to renowned clients across the globe. Along with an extensive range of products, the company reaps the benefits of economies of scale and continue to sustain its market leadership across key products, even in the most challenging circumstances.

The Chiripal Group, incorporated in 1972, has an extensive presence across diverse business segments including petrochemicals, spinning, weaving, knitting, fabric processing, chemicals, infrastructure, packaging and educational institutions. As the Indian textile industry prepares for an unprecedented surge, textile companies are strategically positioned to harness the opportunities presented by this remarkable growth. Recent industry projections indicate that textile exports from India are set to grow, with the domestic market expected to scale up. The anticipated growth in the textile market highlights a broader trend of increasing global demand for quality textiles, driven by the evolving needs of sectors such as healthcare, automotive, and infrastructure. As the industry aligns with global standards and adopts cutting-edge technologies, companies that are agile and forward-thinking stand to benefit immensely.

January 31, 2025 - Combined Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives