Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 15, 2024

Updated: November 15, 2024

This fortnight, we have picked Orient Technologies Solutions as the Fortune Scrip. The company entered the capital market just four months ago – August 21, 2024, to be exact. Its IPO shares were offered at a price of Rs 206, opened at a 47 per cent premium at Rs 302, and are currently quoted around Rs 456.

This multibagger IT company, which commenced operations in 1997, did not take much time in gaining a strong domestic reputation, primarily on account of the quality of its products and services. Its business involves technologically advanced solutions via collaborations with a diverse range of technology partners, including Dell, Fortinet and Nutanix. These partnerships have enhanced the company’s ability to design and innovate products as well as deliver services tailored to specific customer needs.

The company’s IT offerings are broadly categorised into IT products and IT services, covering a wide range of application areas, including (a) IT infrastructure, (b) IT enabled services (ITeS), and (c) Cloud and Data management services.

(a) IT infrastructure: The segment with the longest operational history, it has been the company’s largest revenue generator. Orient Tech has significantly expanded its offerings within this segment and continuously introduces new products such as CrowdStrike, Forcepoint and Netskope, which were added to the cyber-security solutions portfolio.

(b) ITeS: These managed services involve monitoring maintenance and support of IT systems as well as back-up and disaster recovery services.

(b1) Multi-vendor support services: These services provide hardware and software support through annual maintenance contracts encompassing trouble-shooting, repair and maintenance for devices and systems from various vendors.

(b2) IT facility management services: These include both on-site and remote support for system administration, storage administration, cloud administration and network administration, network operations centre services, and securities services and renewals.

(c) Cloud and data management services: These include a range of offerings designed to optimise and manage IT resources.

Orient Tech serves a diverse range of customers across various industries. Its customer base includes entities across both public and private sectors, BFSI information technology, and healthcare/ pharmaceuticals.

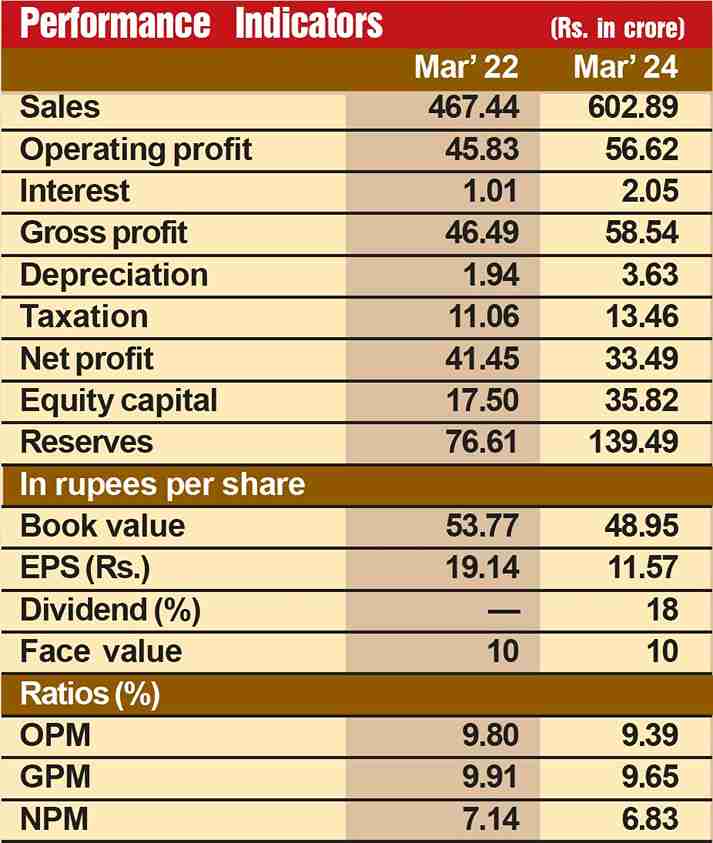

The company has made rapid strides on the financial front. During the last four years, its sales turnover has expanded two and a half times – from Rs 247 crore in fiscal 2021 to Rs 603 crore in fiscal 2024, with operating profit shooting up 19 times – from Rs 3 crore to Rs 57 crore, and the profit at net level spurting 41 times — from nil to Rs 41 crore.

But we have not picked Orient Technologies as the Fortune Scrip because of its enviable performance so far. We strongly feel that going ahead, the company will do even better and will get a place among the leading IT multibagger private entities. Consider:

January 31, 2025 - Combined Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives