Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 15, 2024

Updated: November 15, 2024

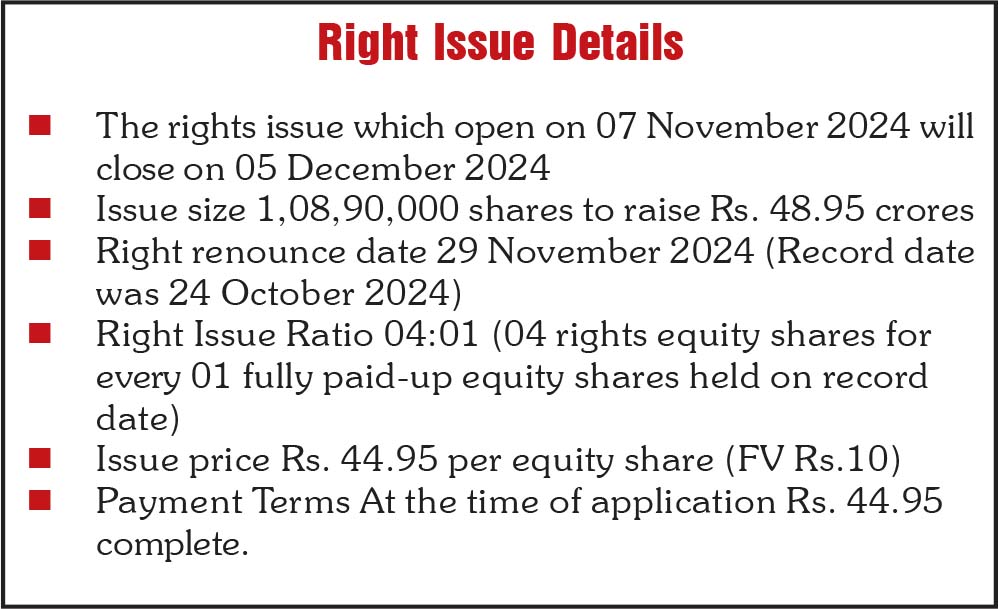

Ahmedabad-based Mercury Trade Links (BSE:512415), engaged in trading agricultural and allied products has entered the capital market with a rights issue of Rs. 48.95 crore on November 7 is receiving good response, the issue will be closed on December 5, 2024. The proceeds of the issue will be utilised for bolstering the company’s working capital to support its growth initiatives.

The rights issue, which will remain available for subscription until December 5, offers a total of 1,08,90,000 equity shares with a face value of Rs. 10 each at an issue price of Rs. 44.95 per share. The record date for shareholder eligibility was October 24, allowing eligible shareholders to apply for additional shares at a ratio of 4:1. This means that for every share held on the record date, shareholders can apply for four additional rights shares. The issue requires payment in full at the time of application.

Shareholders not on record as of October 24 can still participate by purchasing rights entitlements on the market, with the last date for renouncement set for November 29, 2024.

Founded in 1985, Mercury Trade Links Ltd. is an Ahmedabad-based company specializing in the trading of agricultural products and materials, both for domestic and export markets. The company’s portfolio spans a wide range of agricultural commodities, including fertilizers, animal feeds, and an extensive selection of pesticides. Additionally, it trades essential crops and seeds such as rice, maize, soybean, and cottonseed, as well as oilseeds like sunflower and rapeseeds.

Mercury Trade Links sources products directly from agricultural producers through advance payment or mutually agreed terms. These products are then distributed via a wellestablished network of wholesalers and retailers. The company has built strong relationships with both farmers and distributors, and management has demonstrated a robust track record in strategic planning, procurement, and marketing.

1. Agro Product Trading: The company trades a variety of agricultural products, including fertilizers and animal feeds, and is actively involved in selling a wide range of pesticides, including insecticides, herbicides, and fungicides.

2. Agricultural Produce Handling: Mercury Trade Links handles staple crops like rice and maize, along with a broad array of seeds and high-demand commodities such as groundnut, sesame, mustard, and grape seed, serving both domestic and international markets.

3. Resource Development: The company is dedicated to developing agriculture and forestry-based resources. It engages in cultivation on owned and leased farms, operates greenhouses and net houses, and grows medicinal and aromatic plans, supporting sustainable agricultural practices.

With this rights issue, Mercury Trade Links aims to enhance its operational capacity and expand its footprint within the agricultural trading sector. The company’s growth-focused approach and commitment to sustainable resource development position it as a strong player in the evolving agricultural market.

Manufacturing and Trading: Beyond trading, Mercury Trade Links Ltd. has diversified into manufacturing various agricultural commodities and allied products. This expansion strengthens its role in the agricultural supply chain by offering comprehensive services, providing customers with a wider product range, and enhancing its competitive edge in the market.

India’s agriculture sector is on the cusp of substantial growth, driven by rising investments in infrastructure such as irrigation, warehousing, and cold storage. These improvements aim to boost productivity and efficiency. The adoption of genetically modified crops is anticipated to further increase yields, supporting India’s push for selfsufficiency in staples like pulses. To catalysed growth in food processing, the Government of India has extended the Pradhan Mantri Kisan Sampada Yojana (PMKSY), with an allocation of Rs. 4,600 crore ($559.4 million) until March 2026. This initiative will enhance food processing capacities and infrastructure, providing strong growth prospects for Mercury Trade Links in the near term.

Mercury Trade Links has reported impressive financial gains since new management took charge and expanded operations. In the June quarter, the company reported revenues of Rs. 7.90 crores and a net profit of Rs. 71 lakhs, with operating profit margins at 10.51%. For the financial year ending March 2024, the company achieved a net profit of Rs. 13.83 crore from revenues of Rs. 1.14 crore, while maintaining zero debt and reserve funds totalling Rs. 8.73 crore.

The company’s share price currently trades around Rs. 68.02 (14 Nov 2024), with a 52-week range of Rs. 2.24 to Rs. 68.02 and a book value of Rs. 8.42. The rights issue is priced at Rs. 44.95, offering shareholders a favourable discount. Historical performance reflects strong returns: 19.41% over 15 days, 42.43% over one month, 219.16% over three months, and 1,010.45% over six months, making this a timely opportunity for investors looking to gain exposure in an expanding agricultural stock.

January 31, 2025 - Combined Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives