Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: October 31, 2024

Updated: October 31, 2024

The upbeat mood in the Indian stock market got a rude jolt towards the end of the previous Hindu calendar year, Samvat 2080, as a fractious global geopolitical situation continued or worsened, foreign investors shifted their funds to a more attractive China, and a majority-lacking Modi government raised market misgivings about its political and budgetary directions.

Not unexpectedly, the country’s barometric market indices, the Sensex and the Nifty50, fell from highs of 85,978 and 26,277 on September 27 this year to 80,270 and 24,146 respectively.

Moreover Moreover Moreover, the new year, Samvat 2081, will open the door to new market concerns on account of pivotal factors like the results of the November US presidential election, the outcome of state assembly elections in India, the question of whether the RBI will follow the US Fed’s rate-cut lead, and adverse implications for the stock market in next year’s Union budget.

Given the challenging situation ahead for retail investors, Corporate Corporate India has curated a list of 10 scrips with an emphasis on safety and growth.

has been ushered in by India, with buildings lit up like new brides, crackers dominating the soundscape, flares lighting up the night skies across the country, and an exchange of sweets and dry fruits symbolising a season of giving and gratitude. But amid all this seasonal joy, one sector that is not joining in the celebrations is the country's stock market, currently facing serious headwinds.

Contrastingly, Samvat 2080, the year gone by, was -- for the first 11 months -- a golden period for equity investors as stock prices surged to new all-time highs and benchmark market indices reached unbelievable high levels. The country's most popular index, the Sensex, based on prices of 30 pivotal stocks quoted on the BSE, shot up from 64,104 at the end of Samvat 1079 to 85,978 on September 27, 2024, before declining to 80,270. Its twin in popularity and a darling of analysts, the Nifty50, based on 50 leading stocks quoted on the National Stock Exchange spurted from 20,536 to 26,277 on the same day, September 27, 2024, before dropping to 24,146.

The stock market was caught unawares towards the end of Samvat 2080 by a combo of a worsening global geopolitical environment, widespread offloading by FIIs and FPIs, who preferred to move to China on account of attractive valuations and liberal stimuli by the Chinese government to bolster its own industries,a listless corporate performance by Indian companies during Q2FY25, and an uncertain political scenario at home. This precipitated a steady drop of the Sensex to 80,270 and of the Nifty50 to 24,146.

The question now on marketmen's lips is: What will be the outlook for Samvat 2081? Undoubtedly, the beginning of the year will be a challenging one with foreign investors continuing to offload their Indian holdings to invest in China. However, the scenario going ahead will depend on the following macro factors: Elections in US, India: The US presidential election's results will be announced in November 2024. The outcome -- Trump or Harris -- is bound to impact market sentiment not only in the US but also across global stock exchanges, including in India.

Domestically, there are state assembly elections in Maharashtra and Jharkhand this year, and in New Delhi and Bihar in early 2025. The political situation in the country is uncertain as the days of an outright 'Modi majority' at the Centre are over. In these circumstances, the results of these assembly elections will have a significant impact on market sentiment.

Credit policy outlook: The question being asked in Indian trade, industry and market circles after the US central bank, the Federal Reserve, embarked on a rate-cut cycle is whether our own central bank, the RBI, will follow suit. Generally, most central banks, including ours, follow the Federal Reserve's lead, but with Indian inflation reaching skyhigh levels it's anybody's guess what course the RBI will take.

Union Budget 2025: Marketmen are keeping their fingers crossed ahead of next year's Union budget, as the BJP government, lacking an absolute majority in the Parliament, is dependent on its allies. It is feared that in order to please its allies by allocating huge resources for their respective states, the government may tax stock market earnings in one way or another. There are already rumours that the government is thinking of such a measure in the 2025 budget.

FII inflows/outflows: Much will also depend on whether the Indian government takes any steps to stop the continued outflow of money from India to China. Though Indian mutual funds have achieved remarkable growth, the inflow/ outflow of money from FIIs traditionally has a huge impact on market sentiment.

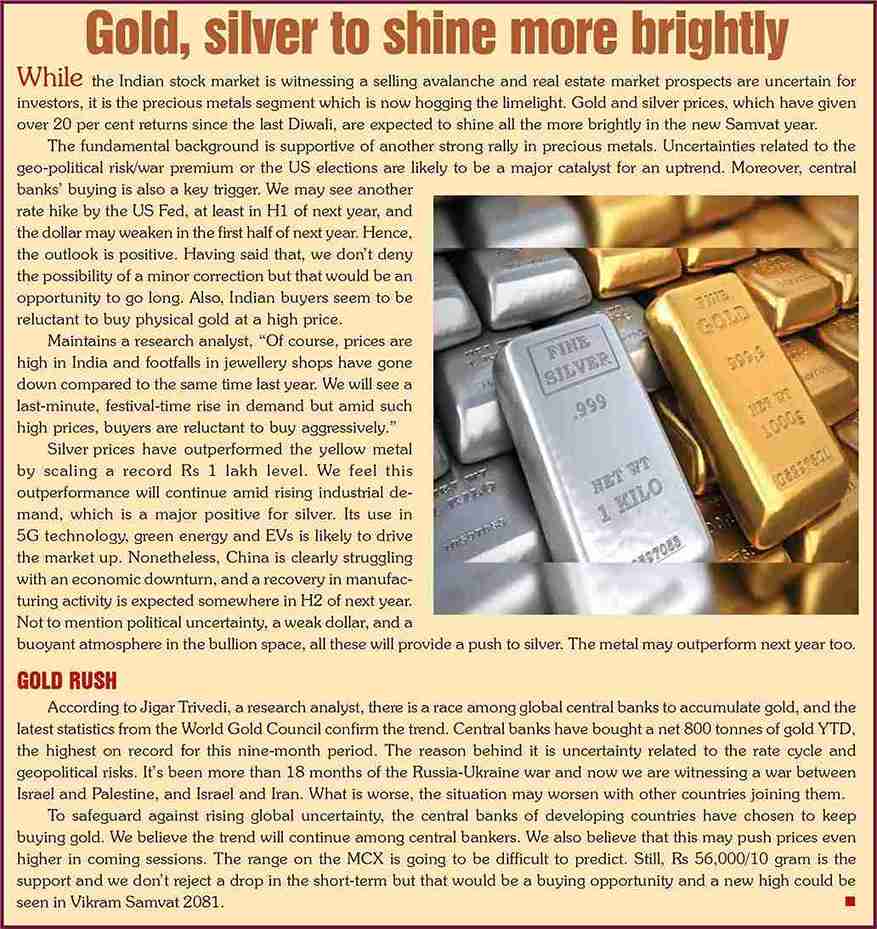

In these circumstances, it is clear enough that Samvat 2081 will be a challenging one for investors in the stock market as the global and local environment will be clouded by several uncertainties, not least by a worsening global geopolitical situation. Interestingly, however, the current situation has opened highly attractive opportunities for investors in precious metals (see box items

All said and done, the current scenario obliges investors in the stock market to adopt a cautious and selective approach, and to invest in stocks that do not erode their wealth. With this scenario in mind, we have selected 10 suitable scrips for our readers. Here goes the list. Happy - and safe -- investing in Samvat 2081!

Mumbai-headquartered ICICI Bank is a large private sector multinational bank and financial services entity engaged in the business of consumer banking, commercial banking, insurance, credit cards, investment banking, mortgage loans, private banking, investment management, asset management, mutual funds, exchange traded funds, index funds, wealth management, stock broking and risk management, among others. The bank offers this wide range of services for retail and corporate customers through various delivery channels and specialised subsidiaries in the areas of investment banking, life and non-life insurance, venture capital and asset management.

The bank is a very large entity with over 6,587 branches and 17,102 ATMs across India. Internationally, it has a presence in 11 countries, with subsidiaries in the UK and Canada and branches in the US, Singapore, Bahrain, Hong Kong, Qatar, Oman, Dubai, China and South Africa. At the same time, it has representative offices in the United Arab Emirates, Bangladesh, Malaysia and Indonesia. The company UK subsidiary has also established branches in Belgium and Germany.

Unfortunately, the bank lost some of its reputation due to the unethical practices of Chanda Kochhar, former Managing Director. But after Sandeep Bakshi took over as MD and CEO, things started changing. The bank started coming into its own and has today emerged as a leading growthoriented private sector bank with a robust financial performance. During the last 12 years, its revenues have more than trebled from Rs 44,885 crore in fiscal 2013 to Rs 159,516 crore in fiscal 2024, with the profit at net level shooting up more than four and a half times - from Rs 10,130 crore to Rs 46,081 crore. Prospects for the company are all the more promising going ahead. In the first half of the current fiscal between April-September 2024, revenues on a standalone basis have amounted to Rs 79,533 crore as compared to Rs 68,246 crore in the corresponding half-time a year ago, with net profit moving up from Rs 19,909 crore to Rs 22,804 crore.

Today, the bank is relatively well-positioned as it continues to outperform peers on most of the parameters, exhibiting strong franchise strength. Thus, its current valuation premium to peers is likely to sustain. Following the announcement of the Q2FY25 results, the stock price on October 29, 2024 moved up over 3 per cent to Rs 1,329.75.

According to Market Mojo, a leading stock analysis platform, the bank's stock has been given a 'BUY' rating. The stock has also been a part of Mojo stocks since January 2024, indicating its consistent performance. Technically, the stock is trading higher than its 5-day, 20-day, 50-day, 100- day and 200-day moving averages, indicating a positive trend in its performance.

In comparison to the Sensex, the stock has outperformed with a one-day performance of 3.12% versus the Sensex's 0.41%. In the last month, the stock has also performed better than the Sensex with a 2.03% increase while the Sensex has seen a decline of 6.13%. Overall, ICICI Bank's stock has shown a strong and consistent performance, making it a favourable choice for investors. With its positive movement and outperforming its sector and the Sensex, it is definitely a stock to watch out for in the banking space.

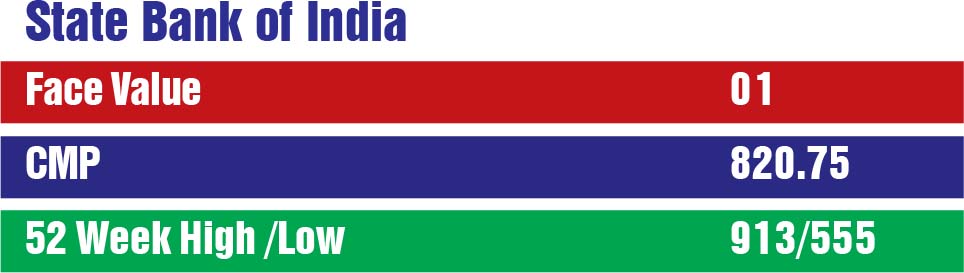

Mumbai-headquartered State Bank of India, the leading commercial bank in the country, is an Indian multinational public sector bank and financial services statutory body. It is the 48th largest bank in the world by total assets and is ranked 78th in the Fortune Global 500 list of the world's biggest corporations in 2024, and is the only Indian bank in the list. It is the largest bank in India with a 23 per cent and a 25 per cent share of the total loan and deposits market. It is also the tenth largest employer in the country with nearly 250,000 employees (2024). 'Global Finance; magazine has named SBI as the 'Best Bank in India' for 2024.

This giant banking entity is engaged in retail banking, corporate banking, investment banking, mortgage loans, private banking, wealth management, risk management, investment management, mutual funds, exchange traded funds, index funds, credit cards and insurance, among others. It has specialised subsidiaries, including SBI Life Insurance, SBI Mutual Fund, SBI Cards and Payment Services, Yes Bank, Andhra Pradesh Gramin Vikas Bank, Kaveri Gramina Bank and Uttarakhand Gramin Bank, among others.

The bank is doing very well on the financial front. During the last 12 years, its revenues have expanded more than two and a half times - from Rs 167,976 crore in fiscal 2013 to Rs 439,189 crore in fiscal 2024, with the profit at net level spurting over three and a half times - from Rs 18,555 crore to Rs 69,543 crore.

In September 2022, SBI emerged as the third largest lender after HDFC and ICICI Bank and the seventh Indian company to cross the Rs 5 trillion (Rs 5 lakh crore) market capitalisation mark on the Indian stock exchanges for the first time. The largest public lender in the country reached a milestone in April 2024 when its market capitalisation surpassed Rs 7 trillion, making it the second public sector undertaking to do so after LIC. In June 2024, the bank crossed an all-time high market capitalisation of Rs 8 trillion, becoming the 7th Indian company to cross this milestone

Today, SBI stands tall among the best performing banks globally. So far, it has delivered a strong all-round performance and has achieved new milestones in profitability with net profit surpassing Rs 600 billion in 2024. The current size of its balance sheet at Rs 62 trillion is more than the combined GDP of almost 174 countries in the world. The bank has demonstrated high agility and superior execution even at this huge size and is well poised to maintain this momentum.

Motilal Oswal, a leading brokerage house, has estimated that SBI will deliver a 16% CAGR in earnings over fiscal years 24-26, backed by healthy loan growth, moderation in opex ratios and controlled credit cost, thus resulting in a FY26 RoA/RoE of 1.1%/18.5%. Motilal Oswal reiterates its 'BUY; rating with a larger price of Rs 1,015.

According to Motilal Oswal, despite already delivering impressive returns over prior years, SBI's consistent performance in RoE and its leadership position in key operating metrics will enable the bank to deliver strong returns going ahead. As India progresses towards its goal of becoming a developed nation by 2047, SBI's strong return ratios and healthy grown momentum should keep investor interest in the bank intact, potentially elevating its position in the global rankings and solidifying its status as a compelling investment opportunity.

The bank remains well-positioned to deliver sustainable growth with high profitability led by healthy loan growth, controlled opex and provisions, and technological advances. Little wonder, the management has guided for broadly stable margins going forward as the bank has measures in place to mitigate the impact of the elevated cost of deposits. According to Motilal Oswal, the bank is well-positioned to sustain its growth trajectory, supported by a low CD ratio, strong underwriting and continued momentum in YONO. The asset quality performance remains strong with consistent improvement in asset quality ratios.

Shares are quoted around Rs 820. Most analysts expect the price to cross the Rs 1,000 mark within a year or two.

Thane(Mumbai)-headquartered Neogen Chemicals is a leading player in the field of manufacturing of bromine-based and lithium-based speciality chemicals. During the last three decades of its existence, the company has developed competencies in other related chemical processes such as alkylation, acylation, amination, oxidation, dehalogenation, halk reaction, friedelcraft, couplings and cholination. By now, it has expanded its range of products to over 250, which find applications across various industries in India as well as globally. These products have gained a strong footprint in over 30 countries, including the US, the UK, France, Germany, Spain, Italy, Japan, Mexico, Canada, South Korea, the Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, Poland, the Czech Republic, the UAE, Saudi Arabia, Israel, Egypt, Taiwan, Australia, Iceland and China.

With its registered office at Thane, the company operates from four state-of-the-art manufacturing facilities located at Mhape, Navi Mumbai (Maharashtra), Karakhadi in Vadodara (Gujarat), Dahej SEZ (Gujarat) and Sangareddy in Hyderabad (Telangana).

The company has made rapid strides in its financial performance. During the last 11 years, its sales turnover has expanded more than 9 times from Rs 74 crore in fiscal 2014 to Rs 691 crore in fiscal 2024, with operating profit spurting 10 times from Rs 11 crore to Rs 110 crore, and net profit shooting up over 11 times from Rs 4 crore to Rs 45 crore. The company's financial position is also very strong, with reserves at the end of March 2024 standing at Rs 73 crore - over 28 times its equity capital of Rs 26 crore.

Prospects for the company going ahead are highly promising. It boasts of a rich client list of over 1,500 customers, including 1,350 domestic customers and 150 international customers. Major customers include Austin Chemical Company Inc of the US, CBC Company Japan, Divis Laboratories India, Lauras Lab India, Sulway Specialities India, and Voltas India.

Primarily engaged in the manufacture of speciality chemicals, Neogen is now planning to carry out multi-step synthesis in equipment of various sizes. It is also focusing on custom synthesis and manufacturing. In fact, work has already started in this area with customers in Japan and Europe.

Further, Neogen has obtained the licence from Mu Ionic Solutions (MUIS), a JV between Mitsubishi Chemicals Corporation (MCC) and UBE Corporation, for availing its proprietary and confidential manufacturing technology for making Neo Solutions at its manufacturing facility in India, with a planned maximum installed capacity of up to 30,000 mtpa. These electrotypes will be targeted by Neogen to meet the growing demand of lithium-ion cell manufacturers in India.

This technology licence will allow Neogen to ensure that the manufacturing plant meets stringent global standards for quality, reliability, safety and efficiency for electrolytes production. It will also help Neogen greatly reduce approval times with lithium-ion battery makers. Neogen is the recipient of this first-ever licence issued by MUIS, the part of MCC for electrolyte manufacturing technology anywhere in the globe. The group's 3-decade long electrolyte manufacturing experience will be extremely beneficial for Neogen to build a robust global quality and safety standards-approved electrolyte plant in India.

In addition, the company has plans to utilise its three decades of expertise in lithium chemistry for manufacturing speciality lithium salts and additives for electrolytes used in lithium-ion batteries and advanced chemistry cells, to produce electrolytes and lithium salts required for electrolytes. Apart from catering to the domestic market, Neogen has so far exported to over 30 countries, including the US, the UK, France, Germany, Spain, Korea, the Netherlands, Belgium, Switzerland, Sweden, Denmark, the UAE, Saudi Arabia, Israel, Egypt, Taiwan, Australia and China.

According to a Kotak Equity research report, Neogen is on track to emerge as the first mover in the battery chemicals segment in the EV segment at India owing to the work it has done in this space, validated by the technology partnership with MUIS-Japan. The company is targeting a marketshare of more than 30 per cent within battery electrolytes in India by 2030 -- a large opportunity.

Additionally, in its base business, Neogen is continuing to investing in new product development and is seeking traction in the CSM business. The company management expects a revenue of Rs 900-1,000 crore from its base business by fiscal 2026 and another Rs 2,500-Rs 2,900 crore from the battery chemicals business by 2029. The company has started receiving committed volumes for battery chemicals from Exide, Amara Raja, Rajesh Exports and others. Kotak Institutional Equities estimates CAGRs of 34 per cent revenue and 40 per cent EPS for Neogen over fiscals 2024 to 2029, led by commencement of battery chemical revenues and supported by continued healthy growth in the base busi-ness of bromine and lithium derivatives

The company's shares are on the rise as there has been sizeable knowledgeable buying of these shares, which has pushed up the price from Rs 1,148 a few months ago to Rs 2,160. Its share with a face value of Rs 10 has tremendous scope for appreciation. Discerning investors will do well to include this stock in this portfolios.

Tata Consultancy Services (TCS), of the illustrious Tata group and the numero uno IT company in India, is a leading IT services provider with a presence in BFSI, communication, manufacturing, retail and hi-tech. The company operates in 150 locations across 46 countries.

Known for consistent revenue growth and industry-leading margins (>25%), the company is the second largest Indian company by market capitalisation.

As of 2024, TCS is ranked seventh on the Fortune India 500 list. In September 2021, it recorded a market capitalisation of $ 200 billion, making it the first Indian IT company to achieve this valuation. In 2012, it was the world's second largest user of US H-IB visas. In 2024, parent company Tata Sons owned 71.74 per cent of TCS, and close to 80 per cent of Tata Son's dividend income came from TCS.

The company has gone from strength to strength on the financial front. During the last 12 years, its sales turnover has spurted almost four times from Rs 62,989 crore in fiscal 2013 to Rs 240,893 crore in fiscal 2024, with operating profit shooting up more than three and a half times from Rs 18,040 crore to Rs 64,296 crore and the profit at net level jumping more than three times from Rs 14,076 crore to Rs 46,099 crore. The company's financial position is very strong, with reserves at the end of March 2024 standing at Rs 101,133 crore - over 280 times its equity capital of Rs 362 crore. The company is known for its consistent organic revenue growth and industry leading margins (>25%)

Prospects ahead are all the more promising. Revenues during FY2025 will be better than the previous year. The management has indicated that discretionary spending deferrals continue but expects the same to pick up in a few quarters. During the last year, the company has won robust deals and the management has indicated that revenue growth will be noticeably better as compared to the last financial year. However, growth will be backended and the management expects dollar revenue to grow by 6.6% in fiscal 2025 and 10.1% in fiscal 2026. Revenue is expected to grow at a rate of 8.3% between FYs 24 and 26 as compared to a CAGR of 8.8% between FYs 2019 and 24.

Describing TCS as an execution engine, HDFC Research adds marketshare gains in vendor consolidation/cost optimisation programmes, and outperformance in margins. The company is known for superior execution even as discretionary spending remains challenged. The FY2024 performance has raised the probability of growth acceleration based on record deal wins in the last quarter bottoming out of core verticals/geo, with scope for further progress on margins. HDFC research analysts expect TCS growth to accelerate from ¾% CC in FY24 to 6.3% and 8.2% in FY25 and FY26, with EBTM at 25.5% and 26% CAGR over FY24-26. They maintain 'ADD MTCS' with a target price of Rs 4,500 based on 28 X FY26 EEPS, in line with its 5-year average PEG.

A 'deal'icious party in fiscal year 2024 injected new blood in TCS and strengthened its fundamentals and pace of growth with quarterly record deals worth $ 13.2 billion in fiscal year 2024 and deal bookings of $ 42.7 billion, which in prior years had reached a maximum $ 34 billion. The large delta in FY2024 bookings can be attributed to Aviva, BSNL and JLR.

Huge record deals were followed by strong execution. As a result, the company's performance was stronger operationally as the company expanded margins by 100 bps QoQ to 26 per cent, leading to an upswing in earnings.

The HDFC research analysts expect TCS growth to accelerate from 3.4% CC in FY24 to 6.8 per cent and 8.2% in FY26, implying a 2% CAGR in both years. They have factored EBITM at 25.5% and 26% for FYs 25 and 26, translating into an EPS CAGR of 11.5 per cent over FY24-26.

Thanks to consistent organic volume growth, record TCV wins and industry- leading consistent margins (>25%), TCS has emerged as a blue chip investment entity in the Indian stock market. Discerning investors should have this stocks in their portfolio.

Hindustan Zinc, a subsidiary of the Vedanta group, is India's largest and the world's second largest integrated zinc producer. It is the world's third largest producer of silver which is a by-product. Initially a public sector company, HZL is now a Vedanta group company in which the group holds a 64.9 per cent equity stake and the Government of India retains a 29.5 per cent stake.

The company's operations comprise lead-zinc mines, hydrometallurgical zinc smelters, lead smelters and pyro metallurigcal lead-zinc smelters, and it is a captive power player in northwest India. The company's total metal production capacity is 1.123 mt. It has manufacturing facilities located in 5 districts of Rajasthan -- Udaipur, Chittorgarh, Bhilwara, Rajsamant and Ajmer - and a district in Uttarakhand. The facilities include the Zawar group of mines, Rajpura Dariba mine, Sindesarkhurd mine, Rampura Agachu mine and Kayad mine, along with zinclead processing facilities in Digbari, Chanderia and Dariba, and a silver refinery at Pantnagar in Uttar Pradesh.

The company is doing fine in its financial performance During the last 12 years, its sales turnover has more than doubled from Rs 12,700 crore in fiscal year 2013 to Rs 28,934 crore in fiscal 2024, with operating profit also more than doubling from Rs 6,528 crore to Rs 13,681 crore and the profit at net level at Rs 7,787 crore.

Mining and metals is by and large a sector that can be affected by global recessionary trends and growing geopolitical concerns. The cycle is expected to take a turn and demand for zinc is likely to move up in coming days. Ventura Securities - a well-known brokerage house -- has taken a bullish position on HZL and has forecast a spurt in sales from Rs 28,934 crore in fiscal 2024 to Rs 39,818 crore in fiscal 2027, while EBITDA could expand to Rs 23,086.9 crore, pushing the company's margin to an impressive 58 per cent. The net profit is projected to shoot up from Rs 7,787 crore in fiscal 2024 to Rs 13,976.4 crore in fiscal 2027. The Ventura report also anticipates the company's ROE and ROCE to remain robust at around 52.3 per cent and 52.4 per cent, and has recommended a 'BUY' at Rs 680.

We feel that HZL is a top-class multibagger and has tremendous potential to grow. We will not be surprised if the share price reaches the four-figure level (Rs 1,000) within the next five years.

Advait Infratech, a part of the vibrant power Infrastructure industry, provides product solutions and services for the power sector, contributing to a safe, sustainable and efficient power infrastructure and environment. The company aims to achieve the highest standards of innovation, professionalism and sustainable growth, keeping in mind the satisfaction rates of employees, customers and shareholders.

The company is in the business of providing products and solutions for power transmission, power substations and telecommunication infrastructure. It operates in verticals such as turnkey telecom projects for installation of power transmission, substations and telecom products, liaisingmarketing and providing end-to-end solutions for overseas customers operating in the field of power transmission and substations.

It provides live-line and off-line installations of OPGW systems. At present, the company is executing about 9,000 km of live-line projects and about 1,200 km are already executed.

Furthermore, Advait has extended its impact into climate services, focusing on sustainability consultancy, decarbonisation consultancy, and comprehensive carbon consultancy services. This strategic expansion aligns with its overarching goal: to contribute to the long-term, comprehensive, and efficient power delivery system of the country by offering cost-efficient and environmentally friendly energy solutions.

The company is going from strength to strength on the financial front. During the last six years, its sales turnover has jumped more than seven times to Rs 208 crore in fiscal 2024, with operating profit shooting up nine times from Rs 4 crore to Rs 36 crore and net profit surging 4 times from Rs 2 crore to Rs 22 crore.

Prospects ahead are all the more promising as there is tremendous growth potential in the power sector in India and elsewhere.

The company's shares with a face value of Rs 10 are quoted around Rs 1770. The price can cross the Rs 3,000 mark within the next 3 years or so.

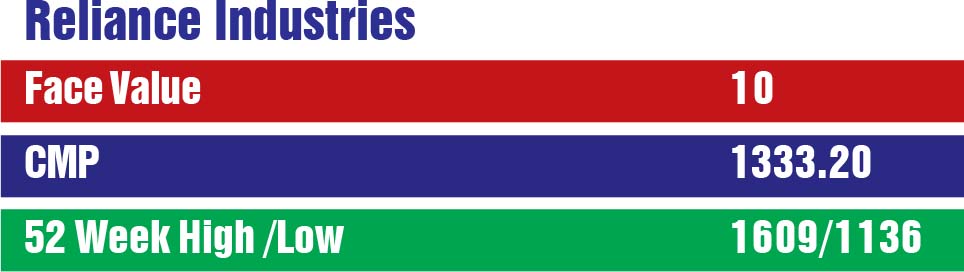

Reliance Industries, the largest private sector corporate entity in India, is the undisputed leader in the petrochemicals and telecom sectors. While the company's refining complete in Jamnagar is the largest in the world and among the most complex, it is also among the largest integrated petrochemicals producers globally.

Promoted by visionary first-generation entrepreneur Dhirubhai Ambani as a textiles company, RIL has diversified into several growth sectors, including oil and chemicals, telecommunication, finance, consumer products and retail. Although refining and petrochem contribute substantially to the company's EBIT, at present it is steadily expanding its investment in consumer retailing and telecom, which are expected to drive the performance of the company going ahead. For speeding up future growth, it is also planning to enter new areas, including green energy.

According to HDFC research analysts, the company's strength lies in its ability to build businesses of a global scale and execute complex, time-critical and capital-intensive projects, which will prove advantageous as it embarks on large investments in all core segments.

Refining margins in Asia will rise due to a 'paradigm shift in regional refining dynamics' from West to East, which will favour a complex refiner like Reliance whose largest cash cow is refining. RIL is currently in a capex phase, investing in worldscale projects like petcoke gasification, off-gas crackers and telecom, which are expected to drive future growth.

Growth is a way of life for Reliance Industries. It has reported sustained growth in its financial performance. During the last 12 years, its sales turnover has advanced from Rs 395,957 crore in fiscal 2013 to Rs 899,041 crore in fiscal 2024, with operating profit spurting around four times from Rs 33,155 crore to Rs 162,498 crore and net profit jumping over three times from Rs 20,886 crore to Rs 79,020 crore. These numbers are expected to grow substantially going ahead on account of recovery in the O2C businesses, EBITDA growth in the digital business driven by improvement in ARPU, subscriber additions and new revenue streams, and the potential for further value unlocking in the digital and retail businesses. RIL's consolidated EBITDA at Rs 410 bn (+32% YoY; +8% QoQ, HSIE: Rs 385 bn) and APAT at Rs 174 bn (+27% YoY, +9% QoQ) came in above our estimates, supported by better-than-expected performance from its energy businesses.

Of course, in the recent meltdown in the stock market, the RIL price has dropped to Rs 1,300 (after its 1:1 bonus issue). This is a good opportunity for new shareholders as the company is fundamentally very strong and its prospects going ahead are highly promising. Again, shareholders will get the benefit of getting Reliance Jio Telecom and Reliance Retail stocks when both these divisions are demerged from the company within the next two years or so.

Headquartered in Pune, Infosys is a highly reputed Indian multinational IT company that offers business consulting, information technology and outsourcing services. On August 24, 2021, Infosys became the fourth Indian company to achieve a market capitalisation milestone of $ 100 billion. As of 2024, Infosys is the secondlargest Indian IT company by revenue and market cap after TCS.

Founded by seven engineers led by N R Narayana Murthy in Pune, with an initial capital of just $ 250 in 1981, Infosys has grown into a giant IT entity. In 1995, it surpassed $10 million in annual revenues, $ 100 million in 1999, $ 1 billion in 2004 and $ 10 billion in 2017. In 2023, its revenues stood at $ 18 billion.

Prabhudas Liladhar, a leading brokerage house, has given a 'BUY' rating to Infosys with a large price of Rs 2,180. Ahead of the US presidential elections, it was quoted at around Rs 1,754 a piece. The company, which holds a massive record of bonus issues, has not carried out any stock split as yet.

Kolkata-headquartered ITC, formerly known as Imperial Tobacco Company, a cigarette manufacturer, is today a leading Indian multinational conglomerate having a presence across six business segments -- FMCG, hotels, agribusiness, information technology, paper products and packaging. It generates a plurality of its revenue from tobacco products. In terms of market capitalisation, ITC is the second highest FMCG company in India (after Hindustan Unilever) and the third largest tobacoo company in the world. It employs 36,500 people at more than 60 locations across India. Its products are available in 6 million outlets in India and exported to 90 countries.

The company has made rapid strides on the financial front. During the last 12 years, its sales turnover has more than doubled from Rs 31,618 crore in fiscal 2013 to Rs 70,866 crore in fiscal year 2024, with operating profit also more than doubling from Rs 11,221 crore to Rs 25,704 crore and net profit spurting around three times from Rs 7,704 crore to Rs 20,751 crore. The company's financial position is extremely strong, with reserves at the end of March 2024 standing at Rs 74,015 crore, almost 60 times its equity capital of Rs 1,251 crore.

Its future prospects are highly promising. The company has entered into a new business venture of cloud kitchens and has set up 12 cloud kitchens and 48 brand outlets in Bengaluru. It has also launched its super app, Meta Market, for advanced agricultural services to provide agricultural and allied services to farmers on a digital platform, under four value chains - wheat, paddy, soya and chillies.

The company's shares (face value Re 1) are quoted around Rs 478. During the last one year, the stock has given a fantastic return of 55 per cent, as compared to the Nifty50 which gave a return of just 2.66 per cent and the Sensex which gave a return of 3.13 per cent. The company is demerging the hotel business and is planning to demerge the FMCG business. Discerning investors should have this stock in their portfolio.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives