Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2024

Updated: September 30, 2024

Even as global uncertainties have seen the price of gold skyrocket, the traditional yen of Indian consumers for the yellow metal is reflected more in gold collateral-linked loans than in gold purchases. This unique financial behaviour is driving the gold loans market.

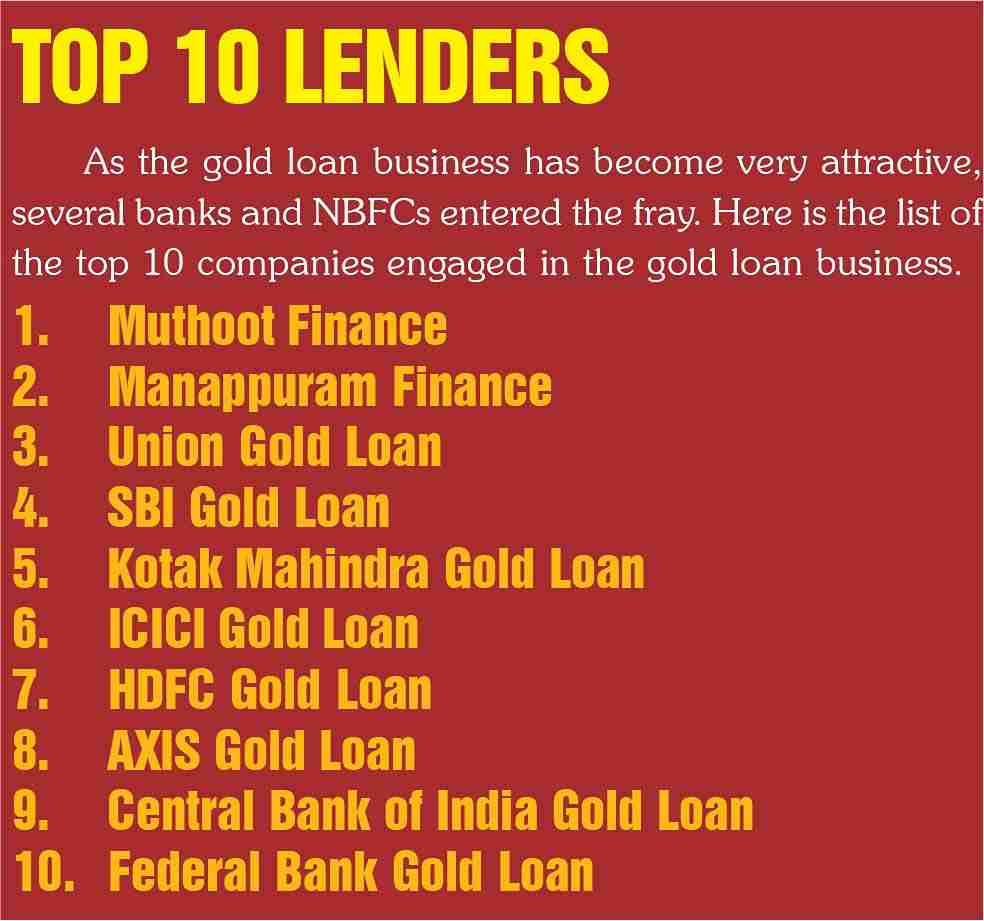

Even as 65% of the market remains unorganised, rating agency ICRA predicts that the organised market, comprising banks and NBFCs, will cross the Rs 10 trillion mark this fiscal and will reach Rs 15 trillion by March 2027. The organised market expanded at a CAGR of 25% over FY2020-24, driven by banks which expanded these loans at a higher CAGR of 26%, while NBFCs expanded theirs at 18% during the same period.

In fact, the organised gold loan market is set for further growth on the back of technological innovation, government initiatives, and a sustained increase in per-gram gold rates. Besides, the growing international market for gold presents opportunities for Indian gold loan financiers to explore overseas opportunities.

Despite intermittent profit taking sales gold prices have been continuously shooting up in India on account of the rising demand. At the time of Independence, the price of the yellow metal was around Rs 88.62 per 10 grams, which has now skyrocketed to Rs 77,500 per 10 gm. Along with the rising trend in gold prices, the gold loan business is also thriving. According to a research report by well-known rating agency ICRA, the gold loan market is set to cross the Rs 10 trillion mark in the current fiscal year ending March 2025 and will reach Rs 15 trillion by March 2027.

A recent report by the World Gold Council (WGC) highlights that gold’s performance has been bolstered by various global events, including the collapse of Silicon Valley Bank, an approaching election year for major economies such as the US, the EU, India, and Taiwan, and the continued demand from central banks. After a roaring 2023, questions have emerged about what can be expected of the gold and gold loan market in 2024.

Gold is often viewed as a safe-haven asset. In times of anticipation of a global economic downturn, investors’ need for portfolio hedges surpasses normal levels, further fueling demand for the yellow metal. In its report, the WGC estimated that central banks’ demand added 10% more to gold’s performance throughout the year, and this trend is expected to continue. Ongoing geopolitical tensions, expectations of rate cuts, and concerns over the health of major economies are likely to support gold prices in the coming year.

In the current year, the bullion market is experiencing an overbought scenario for gold on the MCX, marked by a sustained and singular upward surge spanning almost a fortnight, propelling the precious metal from Rs 56,500 to Rs 60,600. This trend is expected to continue throughout the year.

In India, the second largest gold-consuming country in the world, factors such as a weak rupee, firm overseas prices, and a steady demand from the physical and jewellery market might further push demand for the precious metal, with an expected range of Rs 57,500-75,000 in 2024.

Gold maintains a distinct and revered status as a symbol of financial prosperity in a majority of Indian households, since it is considered to be a tangible marker of social prestige. Gold assets are not merely considered financial assets but are also a symbol of a cultural heritage passed down from one generation to the next. This inter-generational transfer establishes a profound emotional connection and a sentimental inclination towards gold. Despite gold’s liquidity as an asset, the ingrained affinity of the Indian populace for this precious metal manifests in unique financial behaviour. During times of economic adversity, individuals are hesitant to part with their gold assets by selling them. Instead, they turn to the practice of leveraging their gold jewellery as collateral in exchange for shortterm credit through gold loans.

Gold loans are a secured financial product offered by banks and non-banking financial companies (NBFCs) in the regulated environment, and by local money-lenders in the unregulated space. In this arrangement, customers provide their gold jewellery as collateral and, in return, the lending institution disburses the loan based on the prevailing market value of the pledged gold. While there has been a trend towards formalisation of gold loans in recent years, a considerable portion of the market remains unorganised.

With India’s gold loan market mirroring the exceptional performance of the commodity market, an upsurge in loan volumes is anticipated. The demand for safe-haven assets and the increasing value of gold are driving this trend, especially in rural areas where gold serves as a readily available source of credit. Though 65% of the market remains unorganised, India’s gold loan market is estimated to grow at a CAGR of 15%-20%.

The gold loan sector has also seen a rise in fintech companies, leveraging advanced technologies like AI and data analytics for improved risk assessment and a streamlined loan approval process. In the upcoming year, the entry of new players is expected to accelerate this transformation in the gold loan market.

To sum up, in the coming year, India’s gold market outlook remains positive due to rising prices, safe-haven appeal, and increased demand from various central banks. The gold loan market is set for further growth, driven by technological innovation, government initiatives, and the sustained increase in per-gram gold rates.

The process of formalisation of gold loans has been significantly influenced by the increasing levels of urbanisation. This expansion is facilitated by the establishment of new branches, the introduction of digital products, and, notably, the provision of more attractive interest rates and customer service tailored to the needs of urban and rural customers. The evolving landscape reflects the collaborative efforts of organised entities to bring structure and reliability to gold-lending practices, thereby offering a more secure and beneficial financial alternative for individuals in both urban and rural settings.

Globally, there was a 3% growth in the total demand for gold in 2023-2024, with China being the single largest market for gold globally. In China, the consumer demand for gold grew by 16% to reach 959 tonnes in 2023. The growing international market for gold presents opportunities for Indian gold loan financiers to explore market entry opportunities in other global markets.

India was the world's second-largest consumer of gold in 2023. The primary driver for this demand in India comes from the sale of gold as jewellery. The overall demand for gold in India amounted to 747 tonnes in 2023, and is expected to be 750 tonnes in 2024, reflecting a decrease of around 3 per cent compared to previous years. The demand for gold jewellery specifically experienced a yoy decline of 6%, totalling 562.3 tonnes in 2023, as gold prices surged during the year.

ICRA forecasts organised gold loans (GL) by banks and non-banking financial companies (NBFCs) to exceed Rs10 trillion in the current financial year, and projects it to reach ~Rs15 trillion by March 2027. The rating agency has highlighted that banks remain dominant, driven by their gold jewellery-backed agriculture loans. At the same time, NBFCs hold the pole position in retail gold loans and are expected to expand at 17-19% in FY2025. The moderation in competitive intensity is leading to some expansion in the loan yields of NBFCs. However, their yields are expected to be lower by 200-300 bps than the peak levels seen 4-5 years back.

The overall organised gold loan market expanded at a compounded annual growth rate (CAGR) of 25% over the period FY2020-24, driven by banks which expanded these loans at a higher CAGR of 26%, while NBFCs expanded theirs at 18% during the same period. Bank gold loan growth was driven by agriculture loans backed by gold jewellery, which grew at a CAGR of 26% during FY2020-24, while their retail GLs grew by 32% on a lower base. Consequently, the share of NBFCs reduced during this period, largely focussed on retail GLs for consumption or business purposes.

Public sector banks (PSBs) accounted for about 63% of the overall GL in March 2024, up from 54% in March 2019, while NBFCs' and private banks' shares moderated by an equal measure during this period. NBFCs, however, continue to hold a stable share in retail GL over the last 3-4 years. ICRA expects NBFC GL to expand at 17-19% in FY2025 and projects it to grow at a CAGR of 14-15% during FY2026-27.

Growth in the GL book of NBFCs is largely driven by gold prices, as branch additions and the tonnage of gold jewellery held as collateral grew at a modest pace of 3-4% vis-à-vis the 18% growth in the loan book during FY2020-24 for the larger players. The NBFC GL book is quite concentrated, with the top four players accounting for a 83% share in March 2024; this, however, declined from 90% two years ago as some of the existing players have diversified to this segment and some newer players have emerged.

According to an expert, yield pressures faced by NBFCs in FY2022 and FY2023 have abated to some extent in FY2024; however, they continue to remain 200- 300 basis points (bps) lower than the peaks witnessed in FY2020 and FY2021. Credit costs have remained low, staying well below 0.5% in the last five years. Access to collateral and the liquid nature of the same reduce the lender's credit risk. In case of loan overdues, lenders undertake timely auctions, which have helped in healthy realisations.

According to AM Karthik, a leading ICRA official, "A healthy growth outlook, low credit cost and a relatively improved pricing power for gold loan companies support their credit risk profiles. This asset class, however, is highly regulated around various operational aspects, including branch opening, collateral evaluation and storage, auction process, etc. Thus, improving operating efficiencies in view of the above would be the key and provides scope for the players to further strengthen their earnings performance."

As eight of these ten are banking entities, our focus here is on the two NBFCs which are listed on the stock exchanges.

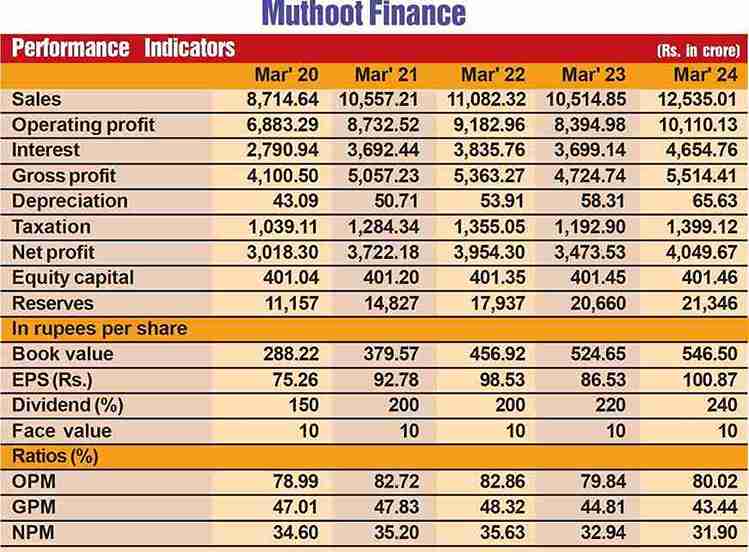

Muthoot Finance, India's largest gold loan NBFC, is one of the largest providers of gold loans in the country. It is renowned in the field and has a vast network of 4,265 branches spread across 21 states and four Union territories. It is also considered the 'most dependable' name in gold financing. Customers can get loans sanctioned against their jewellery for up to Rs 1 crore in a matter of just five minutes. The maximum payback term of 36 months can be extended on request. Interest rates start at 11.99 per cent.

The management takes pride in saying that ever since the word 'ethos' found a place in the corporate lexicon, Muthoot Finance has imbibed a work culture based on ethics. Ever since its inception, the company has nurtured trust as its most prominent value. It believes in a simple yet profound theory of 'from excess or scanty to appropriateness'!

The company has made rapid strides on the financial front. During the last 12 years, its revenues have expanded from Rs 5,387 crore in fiscal 2013 to Rs 12,635 crore in fiscal 2024, with operating profit shooting up more than three and a half times from Rs 1,557 crore to Rs 5,455 crore, and the profit at net level spurting almost three and a half times from Rs 1,004 crore to Rs 3,474 crore. The company's financial position is very strong, with reserves as on March 31, 2024 standing at Rs 2,388 crore - almost six times its equity capital of Rs 401 crore.

The company's shares are in good demand - a share with a face value of Rs 10 is currently quoted around Rs 1,955, after moving between Rs 2,078 and Rs 1,170.

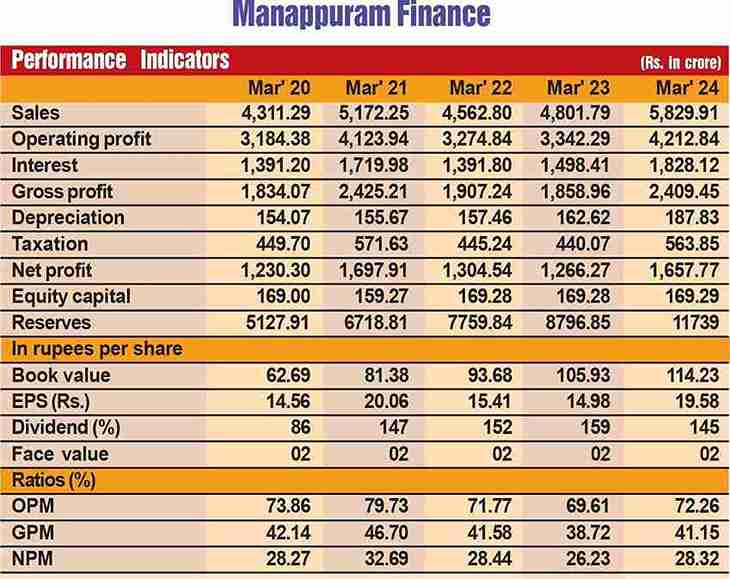

Founded 75 years ago in 1949, Valapad (ThrissurKerala)-based Mannapuram Finance is a well-known name in the finance sector. It has over 3,200 branches spread across the country and is renowned for being trustworthy and processing loans quickly - within just 5 minutes. It provides a wide range of services for people of all income groups, with a maximum loan amount of Rs 1 crore. The maximum payback period is 12 months. However, this can be extended with consent. The rate of interest is 12 per cent

The company's financial performance is extraordinary. During the last 15 years, its revenues have jumped over 50 times from Rs 165 crore in fiscal 2009 to Rs 8,848 crore in fiscal 2024, with operating profit skyrocketing by over 70 times, from Rs 48 crore to Rs 3,134 crore, and net profit also shooting up over 70 times from Rs 30 crore to Rs 2,197 crore. The company's financial position is robust, with reserves at the end of March 2024 standing at Rs 1,137 a crore - almost 70 times its equity capital of Rs 69 crore.

Shares of the company with a face value of Rs 2 are quoted around Rs 197 and there are good chances of their appreciation going ahead.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives